EURUSD failed yet again to push beyond the current range despite last week’s dovish commentary from the ECB. That said, we could see additional selling pressure develop for the single-currency given Friday’s close below the 1.0820 handle.

However, it’s important to keep in mind that, although this level is extremely well defined, it wasn’t respected the last time around on January 5th. For this reason, along with the fact that recent consolidation makes trading risky at best, I’m choosing to take advantage of any Euro weakness via EURGBP, which we will get to shortly.

If the 1.0820 handle holds as new resistance, we could see a push toward the current 2016 low at 1.0708. A break below that may not garner a material amount of selling pressure considering the bears still have to contend with channel support near 1.0650.

Over the past few weeks, GBPUSD has experienced one of the most aggressive declines in recent history. Even the nine-month selloff that began in July of 2014 saw more respite than we’ve seen so far in 2016.

A quick study of our moving averages on the weekly chart shows just how overextended prices have become.

The chart above is enough reason to suspect that buyers will step in this week and provide some relief. However, even a healthy dose of buying at current levels would still be viewed as corrective given the downtrend that continues to dictate price action.

As for where sellers may be compelled to jump back in the market, the 2015 low at 1.4565 is an excellent candidate. A move back to this level would allow the market to “reset” and get back to an area where selling may once again become the name of the game.

EURGBP may present traders with a short-term trade opportunity in the coming week after the pair failed to hold above the 0.7586 handle on Friday. This level has acted as both support and resistance in January, signaling that last week’s close may put additional pressure on the pair moving forward.

Looking lower, immediate support can be found via the trend line that extends off of the December 2015 low. This area also intersects closely with the May and October highs from last year.

A break below this trend line would signal that further declines are likely and would expose the 0.7330 handle. That said, I don’t expect the aforementioned support level near 0.7500 to go down without a fight.

When it comes to confluent areas of “value”, not much is going to beat the 2.00 area on GBPAUD. Not only is this level a major 2015 swing high, it’s also support via a trend line that dates back to 2013.

If that weren’t enough, channel support from the recent consolidation also intersects with this area. Needless to say, the 2.00 handle should see significant buying pressure should the pair retest it in the coming sessions.

On the off chance that the bulls are unable to hold this area, a close below it could present a selling opportunity. However, just know that any short entry would be against the three-year trend, regardless of how favorable it may look.

For those who need a bit more confirmation before jumping in with a buy order, a close above channel resistance near 2.0700 – 2.0800 should do the trick. A break there would expose 2.1400 and possibly the 2015 high near 2.2100.

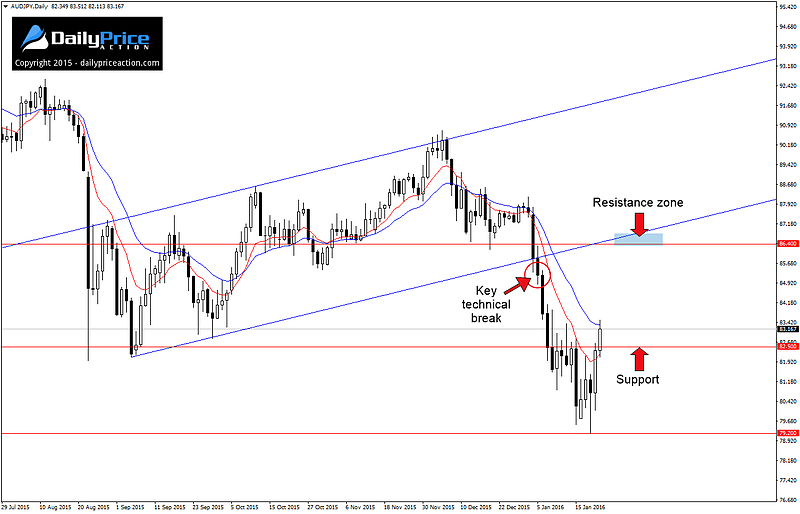

AUDJPY is in the early stages of rebounding off of former lows from 2012. The retest came after the pair broke down from channel support on January 5th and subsequently gave up 600 pips before finally catching a bid.

Although I do think a correction is in order, I’m not interested in a long position here. A look at the weekly chart illustrates the bearish momentum that has been in place since late 2014, therefore any buying is considered to be severely against the grain.

My long-term view for AUDJPY (which is shared by several other yen pairs) favors further downside in the weeks and months ahead. As such, I’ll be content to turn my attention to other currency pairs, such as EURGBP above, while these risk-sensitive pairings revert back to areas where selling can once again be deemed favorable.