When you think of ways to profit from recent Japanese yen strength, the EURJPY is probably the last place you’d look.

Or at least it should be.

The euro has been on an absolute tear lately. I wrote about the potential for a EURUSD breakout on March 2nd and again two days ago.

At the same time, the USDJPY has been on a one-way southbound train

The pair has now lost 450 pips since the short idea that materialized with the sub 109.80 close on February 27th.

Recent strength from both the euro and yen has created a stalemate for the EURJPY.

However, something has to give here.

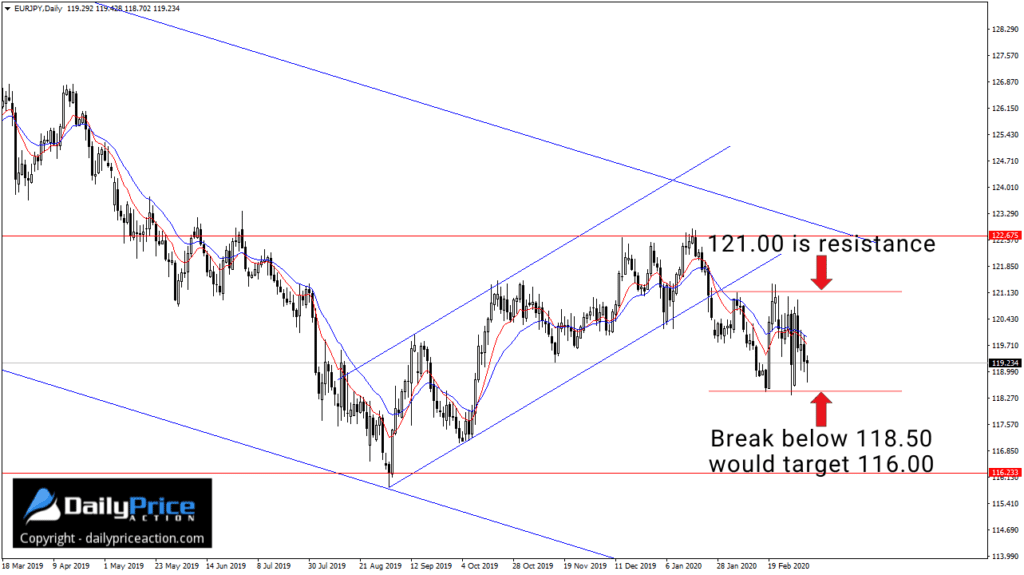

Notice how the EURJPY has been range-bound for several weeks.

The range top comes in just above 121.00, while support is at 118.50.

Now, here’s the key:

We need to see a move below range support at 118.50 for the EURJPY to regain its bearish momentum.

Why am I focused on a move lower, you ask?

I’m more interested in shorts because of the downtrend that has been in place since the start of 2018.

Furthermore, the EURJPY broke down from an ascending channel at the end of January.

So, a continuation of that breakdown could be in the cards.

But I want to reiterate that the euro and yen are locked in a stalemate at the moment.

I also still think USDJPY is the best way to take advantage of yen strength as it’s also fueled by recent US dollar weakness.

I thought that on February 25th and I said the same thing in yesterday’s post. I even wrote that a 100.00 print was possible there.

However, a EURJPY trading sub 118.50 could become an interesting prospect for a move into the 2019 lows near 116.00.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the EURJPY video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in March!

[/thrive_custom_box]