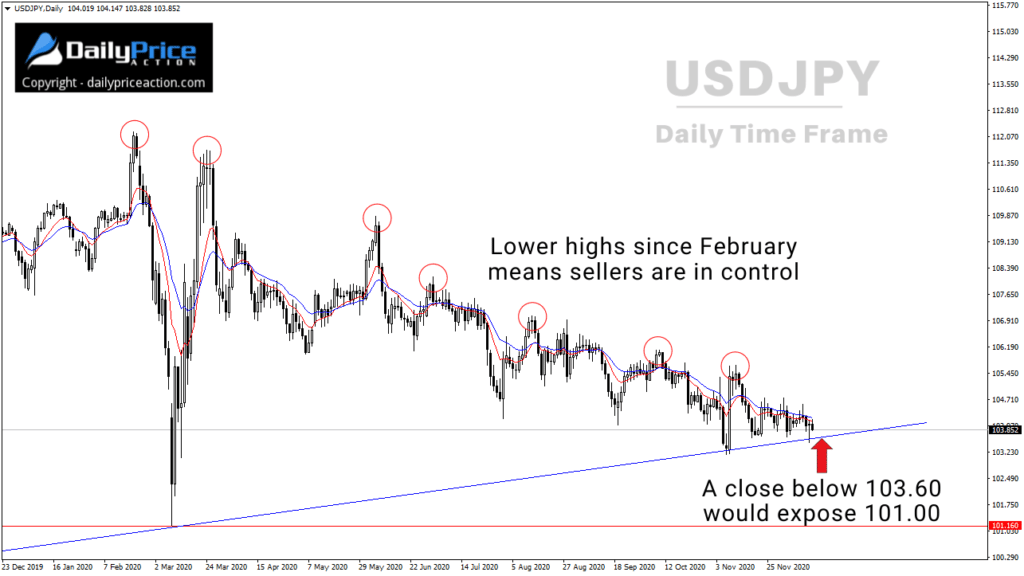

Last week, we looked at what could be a critical trend line support for USDJPY.

The level extends from the September 2012 low and intersects with the March 2020 low just above 101.00.

You can also see how USDJPY caught a bid at this level in November.

It’s the support level that triggered the 200+ pip rally on November 9th.

USDJPY reacted to that trend line again yesterday, which proves to me that the level is significant.

However, instead of buying from 103.60, I prefer looking for a short opportunity.

Why?

There are two primary reasons.

First, USDJPY has been carving lower highs since February.

Even the massive 1,050 pip rally in March failed to carve a higher high.

As long as those lower highs persist, sellers are in control.

Second, the way USDJPY is “weighing” on the 103.60 support area indicates buyers can’t cope with the increased supply.

That could change, but until it does, USDJPY looks weak.

As I mentioned on December 9th, a weekly close below the 103.60 area would open the door to 101.00.

The 101.00 level has been critical since 2013.

A monthly close below 101.00 would open the door to 96.00.

Alternatively, a move above 105.65 would negate or at least delay the bearish outlook.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the USDJPY Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in December!

[/thrive_custom_box]