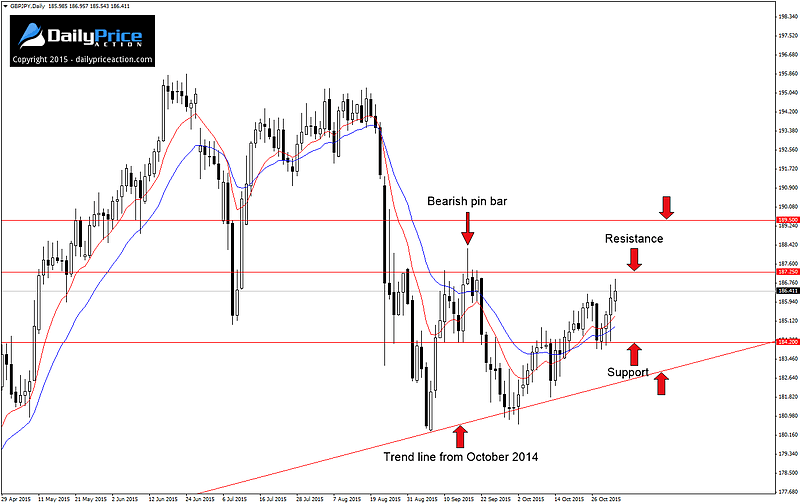

GBPJPY continues to drift higher after testing major trend line support for the fourth time in twelve months. This level extends off of the October 2014 low and has been on our radar for some time now.

Although the pair has found a bid over the last four weeks, it is quickly approaching two key resistance levels that are sure to put the bull’s conviction to the test.

First up is the 187.25 handle. You may remember this level from September when it triggered a bearish pin bar that led to a 600 pip decline. Those who used a 50% entry and targeted the twelve-month trend line managed to pull out a 5R trade (10% profit if risking 2%) on that one signal.

It goes without saying then, that any bearish price action at this level could offer another favorable opportunity to get short.

But if, on the other hand, the bulls manage a close above this level, we can look for bearish price action at the next resistance level at 189.50. This is the 2014 high, which can also be seen acting as support and resistance between May and June of this year.

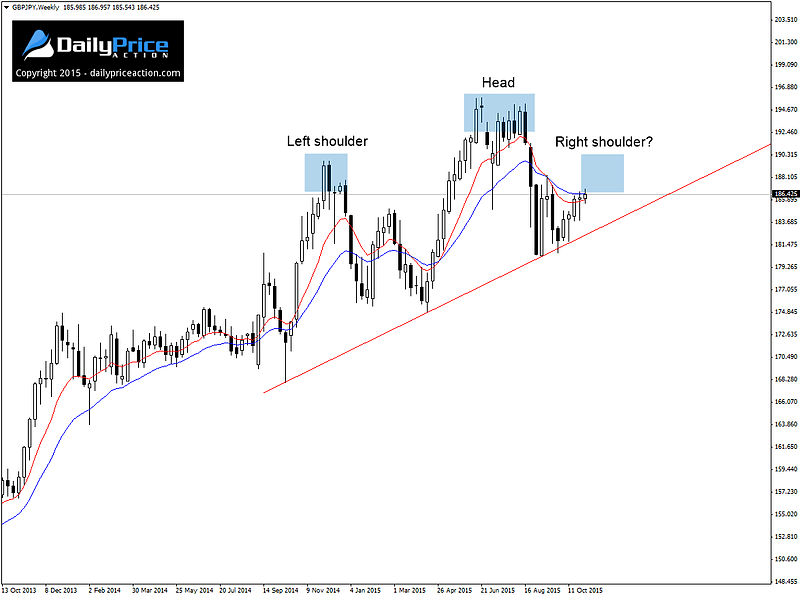

In the bigger picture, I still maintain the idea that GBPJPY likely put in a major top between June and August. Although far from complete and therefore not confirmed, a look at the weekly chart shows what could be the development of a twelve-month head and shoulders pattern.

That said, I do want to reiterate that this pattern is far from complete. Only a move below the neckline would confirm the price structure, which is still 350 pips away. On the flip side, a move above the multi-year high at 196 would negate this entire idea and set the pair up for further gains.

For now though, traders can watch to see how the pair reacts at the previously mentioned resistance levels. Bearish price action at either level could offer a chance to get short for a move back to the trend line that extends off of the October 2014 low.

Summary: Watch for bearish price action on a retest of the 187.25 level. A daily close above that would have us watching for similar price action at the 189.50 handle. Key support from current levels comes in at 184.20 as well as trend line support off of the October 2014 low. Alternatively, a daily close above 189.50 would negate the bearish bias and would likely put pressure on the multi-year high at 196.