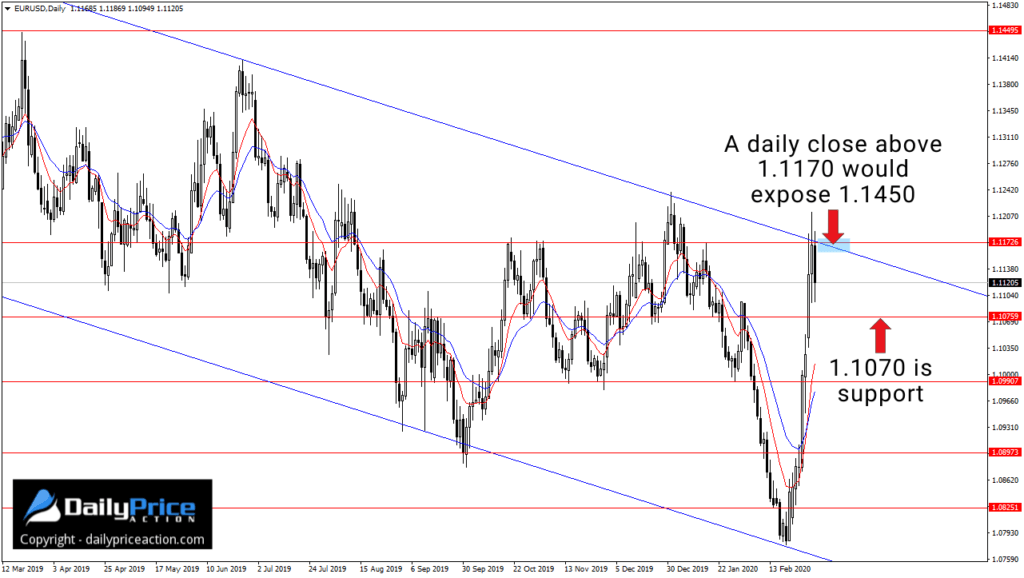

On February 13th, I pointed out a EURUSD support level just below 1.0825.

It’s the bottom of a descending channel we’ve used to trade the euro since September of last year.

Then on February 26th, I mentioned how a close above 1.0900 would expose 1.0990 and perhaps the top of the channel near 1.1170.

That 1.1170 figure is the same one I wrote about on Monday.

Notice how Tuesday’s session closed at 1.1169.

That’s no coincidence.

As I wrote on Monday, EURUSD bulls need to clear that 1.1170 area on a daily closing basis to expose higher levels.

Until they do, the euro will struggle.

But a market stopping one pip below a key resistance level is a good thing.

Not because I want to short EURUSD (because I don’t), but because it tells me that 1.1170 is, in fact, a significant level that could trigger a break higher.

I still maintain the idea that a break above the 2019 descending channel top near 1.1170 is only a matter of time.

That doesn’t mean it will happen this week or next, but I do think a continuation of this latest rally is likely.

And if we do see buyers take out 1.1170, a move to 1.1450 is my base case scenario.

In Monday’s members-only video, I pointed out how the rally that began on February 21st formed a v-shaped bottom.

Today’s pullback hasn’t changed that.

So, I still have no interest in selling the EURUSD.

I would prefer to either buy at support on the way down or following a daily close above that 1.1170 resistance area.

Two key support levels to keep an eye on include 1.1070 and 1.0990.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the EURUSD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in March!

[/thrive_custom_box]