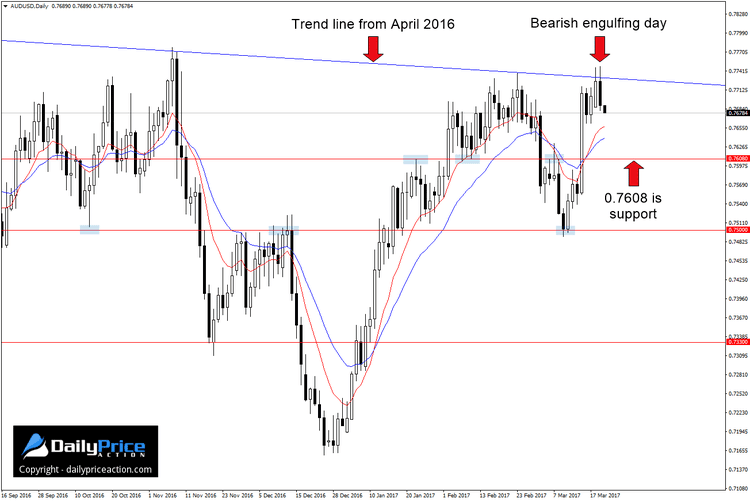

The Australian dollar has been one of the more resilient currencies against the greenback so far in 2017. Between January 1st and February 23rd the pair gained an impressive 550 pips.

I went short at 0.7730 on the February 23rd retest of resistance and also added to the position using the bearish pin bar that formed on March 7th. All in all, it was a good trade, although not quite as long lasting as suspected given the velocity of the March 2nd selloff.

A more dovish than expected Fed triggered last Wednesday’s rally, which made March 2nd look insignificant by comparison. The 150 pip single session rally put the pair back above the key 0.7608 handle.

However, the past 48 hours have once again challenged trend line resistance that extends from April 2016. This is the same level that triggered last month’s 250 pip decline.

Despite their best effort, buyers were unable to punch through this area yet again. Instead, they were confronted by enough selling pressure to carve out a bearish engulfing candle.

The pattern hints at a turn lower for the Aussie dollar. How low is anyone’s guess, but at the moment the next key support doesn’t come in until 0.7608. This level is one we’ve discussed several times over the last few weeks.

A daily close below 0.7608 would pave the way for a move toward 0.7500 followed by minor support at 0.7450. Although quite a bit lower, another critical level I’m keeping an eye on is 0.7330 as it’s the 50% retracement of last year’s range.

Want to see how we are trading this setup? Click here to get lifetime access.