With 24 hours to go before Janet Yellen takes center stage, market participants continue to jockey for position for what will surely be a market moving event.

I’ve never been one to speculate on what the Fed may or may not do, and I don’t plan to start now.

However, there’s nothing wrong with attempting to identify a consistent theme within a market in preparation for such an event. And a look at the major currency pairs illustrates the idea that the US dollar is waiting for the right catalyst to push it higher.

Here are a few examples that support this notion:

- EURUSD breaking below a confluence of support on Friday

- GBPUSD falling back inside the post-Brexit wedge pattern (false break to the upside)

- AUDUSD selling off from three-year channel support

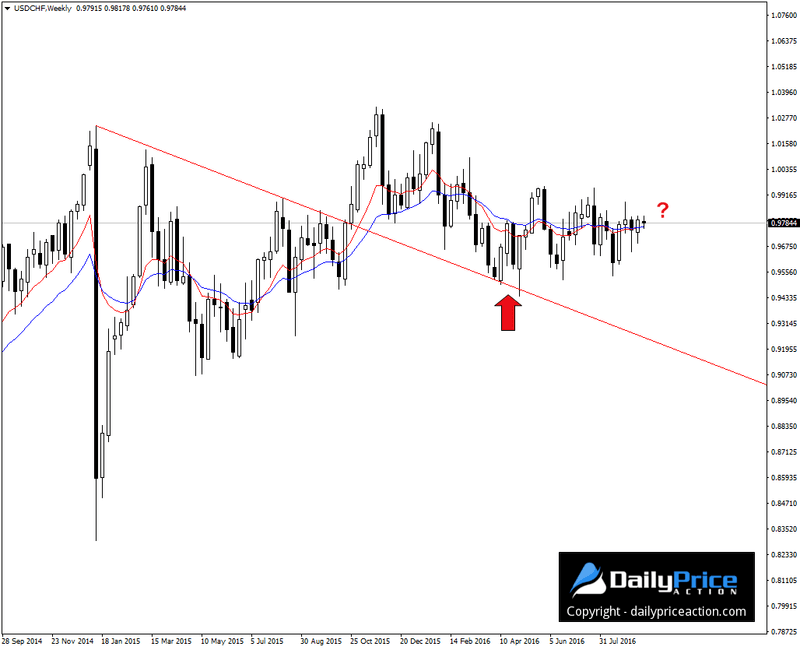

Another pair with enormous potential is USDCHF. I mentioned the break above what was a long-standing resistance level at the beginning of the year, and although prices have remained subdued, that bullish breakout is still intact.

Here’s how that level looks today:

One reason I’m interested in this pair is due to the lackluster volatility over the last five-plus months. We all know that volatility can create opportunity and is an essential ingredient to make money in any market.

But a lack of volatility for an extended period can be a sign of a pending breakout, and the price action over the last five months certainly fits that description.

Whether or not tomorrow’s FOMC becomes the catalyst for USDCHF and the other pairs mentioned above is anyone’s guess. But from a purely technical view, the US dollar appears ready for a move north.

A close above eight-month channel resistance would expose the 0.9950 handle while a move lower would likely encounter support at 0.9650.

Want to see how we are trading this setup? Click here to get lifetime access.