If you read my blog post from last week, you know I’m not bullish the global economy in 2016 to say the least. While the post was by no means a dissertation on how the corollary effects of global asset prices point to a widespread meltdown, the mere fact that I’m so bullish the Japanese yen insinuates the same bleak outlook.

The way 2016 has unfolded thus far certainly reinforces this theory, with equity markets here in the US and abroad off to their worst start to the year ever. And for those who are curious, those stats, courtesy of FactSet, date back to 1897.

But last week isn’t the first time I mentioned the idea of yen strength in the face of fear and uncertainty. In fact, a look back through the pages of the member’s community shows that I first mentioned the NZDJPY exhaustion, among other currency pairs, that was taking place in July of 2014.

I don’t say this to brag, but rather as a reminder that the price structures we’ve seen develop over the last year and a half, namely the various head and shoulders patterns, have been signaling for quite some time what many (although not enough) are just now accepting as probable – that fear and volatility are here to stay.

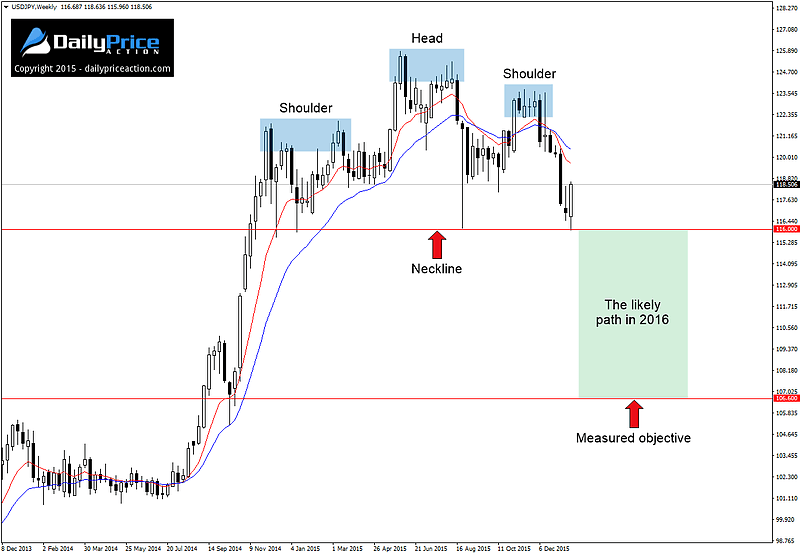

One such currency pair that is in the process of topping but hasn’t yet capitulated is USDJPY. After spending four years rallying for a massive 5,000 pips (almost exactly), the pair now finds itself in a precarious situation as it teeters on the brink of a major collapse.

Like so many other yen pairs recently, USDJPY has formed a head and shoulders reversal. The pattern began forming in early 2015 and appears to have now completed the right shoulder. All that’s left is a close below the neckline at 116 and we have a structure that could push prices as low as 106.60 over the coming weeks and months.

So what’s the problem, you ask?

Well, it isn’t really a problem, unless of course you have a mid to long-term bullish bias for the USDJPY. I bring this up because as I surf around the internet, I can’t help but see the bullish cases being made for the pair and even the equity markets as a whole.

Seeing this, I felt compelled to write a brief “word of caution” to those who are already on the bullish bandwagon or those who are seriously considering the idea of joining, all of which is simply my opinion and should therefore be taken as such.

Although nothing in the Forex market (or life in general) is for certain, one thing I can say without a shadow of a doubt is that other currency pairs and global markets alike have been pointing to a rather bearish scenario since late 2014. So while the current relief rally we’re seeing in equities as well as USDJPY could give rise to higher prices in the short-term, it isn’t likely to be material or sustainable.

I’m reiterating this now because the more I look at these markets, the more I’m convinced that we are getting to a point where only the diligent traders will survive. Of course an argument could be made that in a market as wild and volatile as Forex, a statement such as this is timeless; and I would absolutely agree.

However, major market tops, such as those witnessed in the 2008 era, are periods in history where wealth can quickly change hands. But in order to accommodate the “new wealthy”, weak hands must be shed from the market.

Which brings me to the main takeaway from all of this…

During periods of major market tops and increased volatility, the majority of the profits go to those who stay patient, but more importantly, to those who keep the big picture in mind at all times.

I’ll end with a weekly chart of USDJPY, which is perhaps the most accurate gauge of fear in the currency market, and let you decide for yourself.