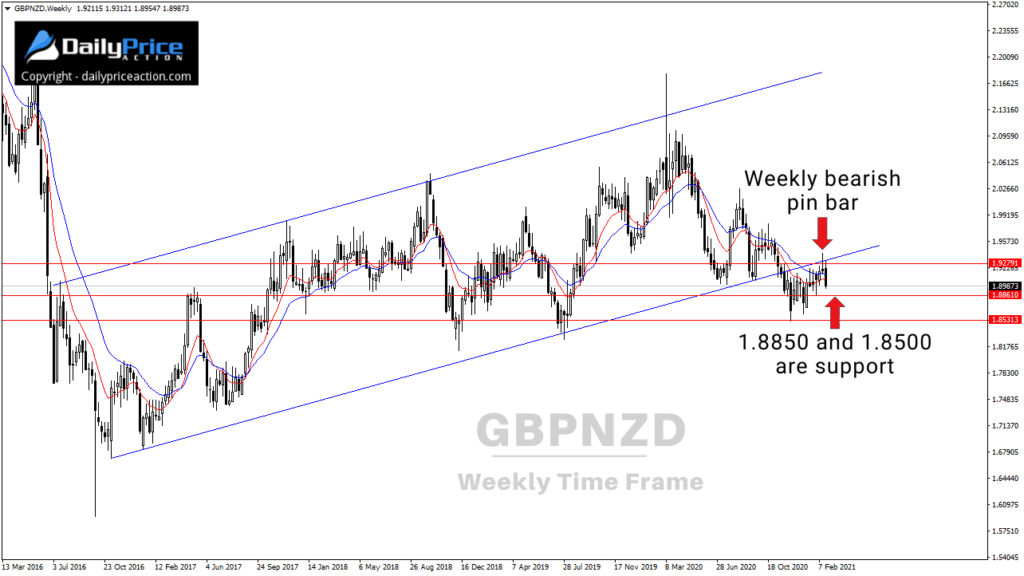

Last weekend, I mentioned a potential GBPNZD short opportunity.

The pair was testing the bottom of a long-standing ascending channel.

I’ve discussed this pattern at length on this site.

In fact, we caught the initial selloff from the breakdown last November, which took GBPNZD more than 600 pips lower.

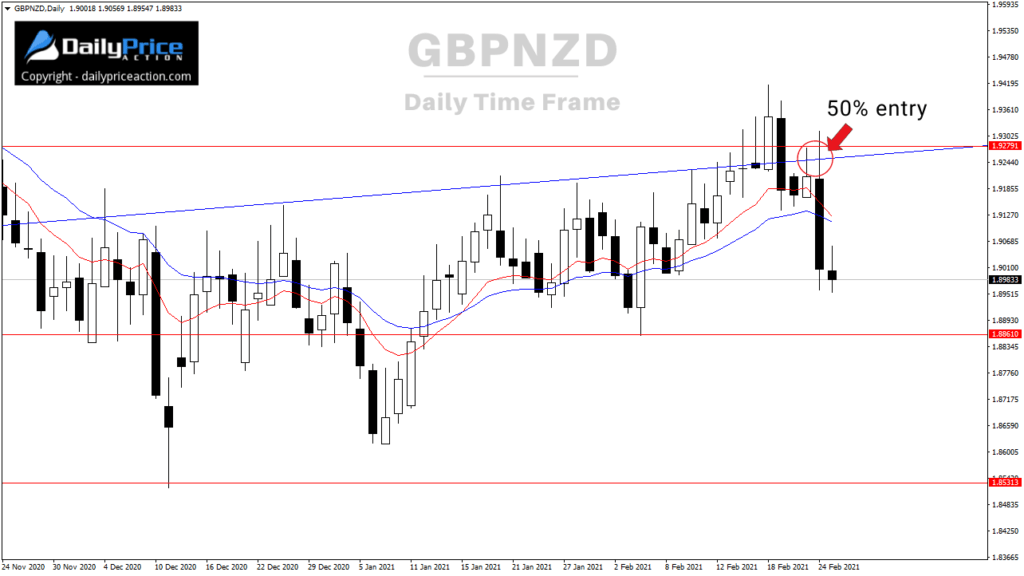

If you saw last weekend’s forecast video, you know I was eyeing 1.9280 for a short.

That’s the 50% retracement of last week’s range, which was also a bearish pin bar.

I talk about the 50% entry strategy in this post.

Notice where GBPNZD carved a high on Wednesday of 1.9312 before collapsing 350 pips.

That 1.9312 high was just 32 pips above our 1.9280 entry; not bad.

Anyone who sold at 1.9280, as I mentioned last weekend, was able to make this a risk-free trade within hours if they so choose.

As of today, GBPNZD still looks relatively weak, so I do expect further downside.

The next logical key support is around 1.8500.

I expect some buying pressure near 1.8850, but given the recent rejection from former channel support, a run at 1.8500 appears likely.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the GBPNZD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in February!

[/thrive_custom_box]