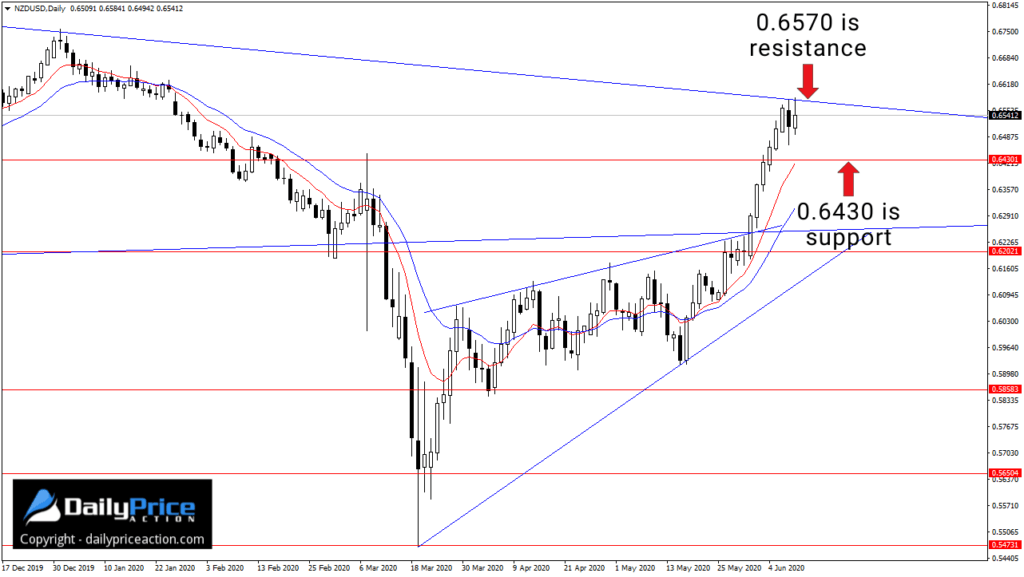

The NZDUSD is at a pivotal price near 0.6570.

That’s the resistance area I pointed out in Saturday’s weekly forex forecast.

You can see where the New Zealand dollar encountered selling pressure near 0.6570 during Tuesday’s session.

However, on Wednesday, NZDUSD buyers pressured the 0.6570 resistance area once again.

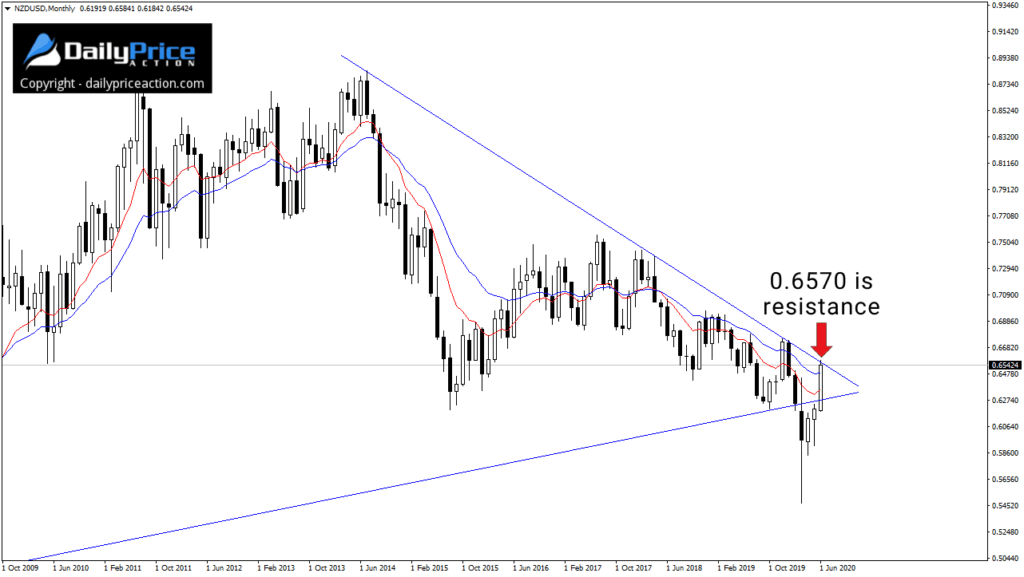

The reason 0.6570 is significant has to do with the multi-year wedge pattern that’s been developing since the 2014 high.

As I pointed out on Saturday, the multi-year wedge broke down in March.

The NZDUSD later tested 0.6200/50 as new resistance at the end of May, but buyers eventually broke through the area on June 1st.

Now comes the key test for this breakout.

Will NZDUSD manage a weekly and perhaps monthly close above 0.6570/80, or do we see sellers regain control?

Either way, I have no doubt that June’s close will be incredibly telling.

In the meantime, it’s going to come down to the coming daily and weekly closes as they relate to 0.6570/80.

You may be wondering why I wouldn’t short NZDUSD here or look to go long following a close above resistance.

The reason I’m doing neither is that I don’t fully trust this move yet.

As I mentioned in Saturday’s video, I want to see how NZDUSD reacts to this area at the June close.

Another reason I’m not buying NZDUSD right now has to do with the June range which has already exceeded 300 pips.

That means the odds of the New Zealand dollar appreciating another 100 or 200 pips in June is pretty slim.

We’ll see what happens, but for now, 0.6570 is resistance with support coming in at 0.6430.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the NZDUSD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in June!

[/thrive_custom_box]