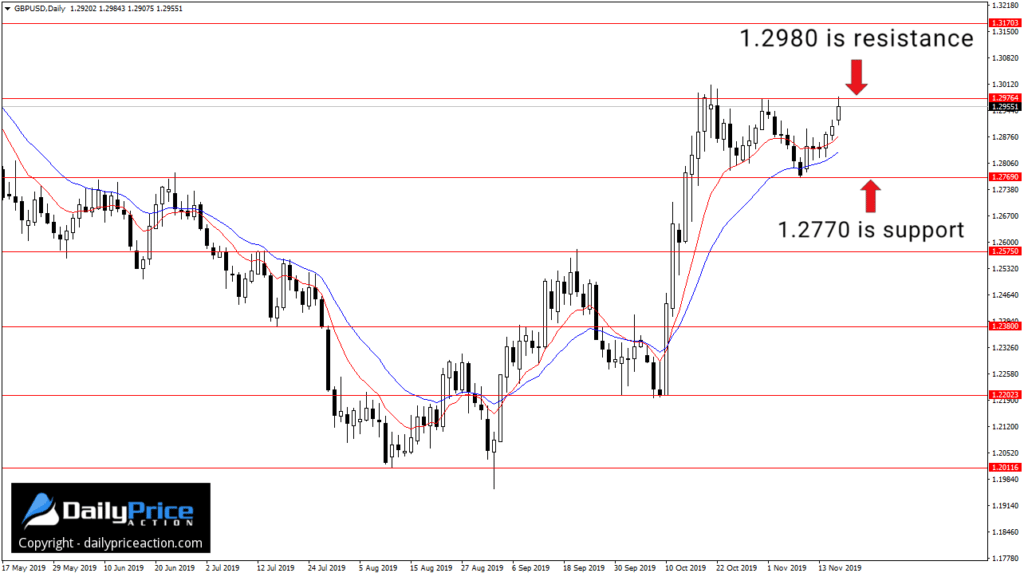

The GBPUSD is testing a critical resistance level today.

The 1.2980 region has held as the range top since the pair closed above 1.2770 in mid-October.

I wrote about the 1.2770 support area on November 7.

And if you watched this past Saturday’s Forex forecast video, you know I favor a break higher from the GBPUSD.

Here is Saturday’s video in case you missed it:

The reason why I favor a move higher is two-fold.

First, the GBPUSD is maintaining its short-term uptrend per the higher lows and higher highs since September.

And second, buyers are refusing to back down while above 1.2770 despite the recent 800 pip rally.

That doesn’t mean the pair will break higher, but that would be the ideal scenario given the factors above.

Just keep in mind that 1.2980 is still serving as resistance as of this writing.

As I pointed out in Saturday’s video, GBPUSD buyers need to secure a daily close above the 1.2980 area to confirm the breakout.

The “daily close” when trading price action refers to the New York 5 pm EST close. These charts are essential for trading price action.

Go here to get access to the same New York close charts I use.

Until that occurs, 1.2980 will attract sellers as it has so far today.

A daily close above 1.2980 would expose the next key resistance level at 1.3170.

Alternatively, bearish price action, such as a pin bar from the 1.2980 region could keep sellers in control a while longer.

But it’s going to take a daily close below 1.2770 to expose lower levels.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the GBPUSD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in November!

[/thrive_custom_box]