EURUSD ended Friday with a significant break, closing below channel support near 1.0950. This came after the pair failed to recover back above the 1.1060 handle after sliding below it last Monday.

Unless former channel resistance that extends off the December 15th high can support prices in some meaningful way, things could get ugly from here. Speaking of, while I do believe that this level (shown in the chart below) could provide interim support, I would be surprised to see it attract a lasting bid.

Since September of last year, I have maintained the idea that the price action over the last thirteen months has been consolidation that could eventually take the pair much lower. As of this writing, I have no reason to suspect otherwise.

The retest of former channel support on February 11th has played out nicely thus far, and if last Friday’s break is any indication, the pair may well be on its way to retesting the December 2015 low at 1.0515.

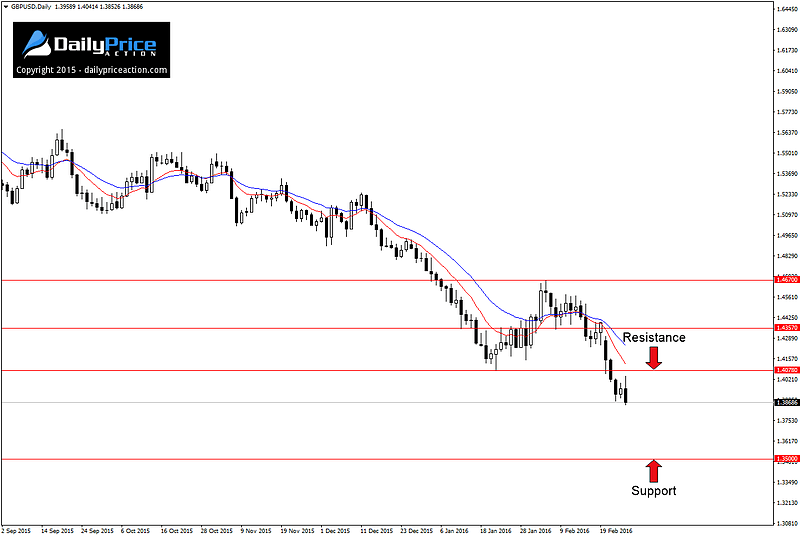

GBPUSD had one of its largest weekly losses since November of last year. This came on the back of Brexit concerns that pushed the pair below the seven-year low at 1.4078.

Although the pair is fairly extended at current levels, any advance from here will likely be capped by the former 2016 low. If this level were to come under pressure as new resistance, it could present traders with a favorable opportunity to get short.

That said, I’m not a huge fan of trading GBPUSD, and instead favor taking advantage of any pound weakness via other currency pairs. An example of this was last week’s GBPCAD setup, which is quickly nearing its 900-pip profit target.

As long as GBPUSD remains below 1.4078 on a daily closing basis, there isn’t much to stop the pair from reaching the 2009 low at 1.3500.

NZDUSD finished the week with a bearish engulfing pattern, signaling that Thursday’s break of the ten-month trend line was without conviction. However, the choppy price action of late means that even the most telling signals can be hard to read.

I also don’t like the fact that 0.6540 support level lies just 70 pips below trend line support that extends off the 2016 low. So while the pair could break down further in the week ahead, there doesn’t appear to be a clear opportunity from a risk/reward perspective.

A retest of the 0.6540 handle looks imminent, and a close below it would expose the 2016 low at 0.6346. I will stand aside for now and continue to monitor this one over the coming sessions to see if a favorable opportunity presents itself.

EURNZD tested trend line support from April of 2015 last week. This came after the pair failed to hold above key support at 1.6580.

To be clear, this is not something I’m interested in trading at the moment, at least not until it can clear trend line support on a daily closing basis. If that happens, the 1.5840 level could quickly come into play as support.

Also of note is the pair’s failure to push above the 1.7200 handle between January and February. At the moment, this appears to have formed a lower high, but of course nothing can be confirmed until we get a close below trend line support.

EURJPY pushed below a key level at 126.15 recently and looks to have more downside potential in store. Although I’m skeptical as to whether the pair can find enough buyers to retest 126.15, I’m also not willing to chase prices lower.

I realize that there are other levels at play here besides the two horizontal levels shown below. However, in order for me to consider risking capital in EURJPY, I need to see 126.15 challenged as new resistance in order to reset prices and allow new short positions to be established.

Until that happens, it seems the pair will remain too extended to secure a favorable entry from a risk/reward perspective.