[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts. Click Here to Use My Preferred Broker

[/thrive_custom_box]

EURUSD bulls gave back nearly 200 pips last week. It was the first losing week since mid December of last year.

On Monday of last week I pointed out that the EURUSD was vulnerable below 1.2435. The price had started to lean on the lower boundary of the 4-hour ascending channel, suggesting that a breakdown was imminent.

As I was publishing the post, the single currency closed at 1.2428 on the 4-hour chart, signaling a clean break of channel support.

Although we saw immediate downside pressure following the break, the next 24 hours were filled with a lot of back and forth action. However, I remained bearish given that the pair was staying well below former channel support.

The first key level below 1.2435 came in at 1.2325. We saw this area come under pressure during Tuesday’s session, buy buyers held their ground into the close.

That changed on Wednesday. The 1.2262 close put the single currency well below the key level at 1.2325. It also exposes the next area of interest at 1.2160 followed by 1.2080.

As long as the 1.2325 handle holds as new resistance on a daily closing basis at 5 pm EST, I favor a move lower toward 1.2160 and perhaps 1.2080.

There is also significant trend line support that comes in near the 1.2080 handle. A retest of that level will mark a pivotal moment for the single currency. See Wednesday’s commentary for more.

I love the technicals on the GBPUSD at the moment. In fact, the technical landscape across a variety of markets is the best I’ve seen in quite some time.

In last week’s forecast we were focused on two levels. One was resistance at 1.4335, and the other was support at 1.4070.

Although the bullish momentum was intact, I wasn’t convinced that last week would set new highs.

Here’s what I wrote on February 4:

The fact that buyers were unable to force a second retest of resistance at 1.4335 last week may suggest a pullback is in order. Still, as long as 1.4070 support holds on a daily closing basis (5 pm EST), shorts should tread carefully.

A close below 1.4070 would pave the way for a move toward the 1.3850 area. A break there would bring prices back to the January 3 high at 1.3610.

The close below 1.4070 came just 24 hours after that post. Tuesday’s session then found support at 1.3850, and after bouncing around for a couple of sessions, buyers pushed Thursday’s session back to 1.4070 or just four pips below it.

On Thursday I labeled the retest of 1.4070 as a temporary setback for sellers. I wrote that I would remain bullish the GBPUSD while above 1.3610, but that this uptrend needs to unwind a bit more.

That’s precisely what happened on Friday. The weekly close below the 1.3850 handle suggests further downside for the week ahead.

Keep a close eye on 1.3610. Much like the importance of the 1.2080 area on the EURUSD, the GBPUSD’s 1.3610 handle holds the answer to the pair’s future direction over the weeks and months to come.

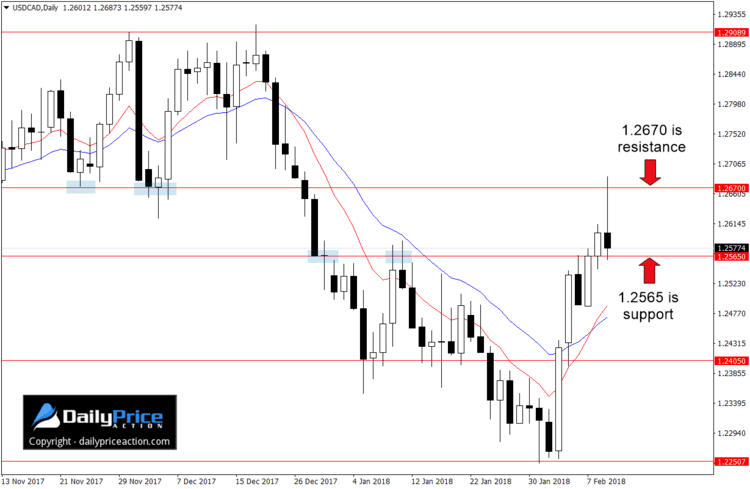

I hope some of you made money from the USDCAD last week. Much like the GBPUSD above, the USDCAD has been respecting technical levels exceptionally well since October of last year.

Last Sunday I pointed out how buyers had breached the 1.2380 to 1.2400 area. That meant further upside was likely as long as the 1.2400 area held as new support on a daily closing basis.

Monday’s low was 1.2397, and just 48 hours later the pair reached our first target at 1.2565. In fact, Tuesday’s high was 1.2566, one pip above the key level I mentioned last week.

The 1.2565 resistance level broke down on Thursday and Friday’s price action reached yet another level we’ve had on our radar at 1.2670. This is the former range support that attracted a bid between November and December of 2017.

Now, before you rush off to sell Friday’s bearish rejection candle, know that sellers did not breach the 1.2565 handle. They tried but ultimately failed.

Whether or not 1.2565 fails at some point this week is anyone’s guess. But as long as it holds as support on a daily closing basis (using New York close charts), a push higher should not be ruled out.

Key resistance for the week ahead remains the 1.2670 area. A daily close below 1.2565 would re-expose the 1.2400 support area.

We’ve been tracking the EURJPY for weeks. The first thing that caught my attention was the topping formation that I mentioned on January 23. Then came last week’s close below rising wedge support.

Thursday’s close below the 134.00 area was a significant development. And it isn’t over yet in my opinion, not by a long shot.

The risk on environment since the U.S. elections in November 2016 is partly responsible for the weaker Japanese yen over the last 15 months.

In fact, the flight to risk is the main reason we’ve seen pairs like the EURJPY and GBPJPY soar to fresh multi-year highs.

Unless you’ve just come back from another planet, you have no doubt seen what has happened to global equities in the last couple of weeks. It’s no coincidence that pairs like the EURJPY and GBPJPY have suffered alongside equities.

And in my opinion, the breakdown you see below, and that of GBPJPY (up next) is a warning sign of things to come. In other words, I’m expecting the rotation from risk assets to safe havens to intensify in the coming weeks and months.

Now, that doesn’t mean we won’t see some strength from the EURJPY along the way. Friday’s price action is a prime example. Sellers got a little too far ahead of themselves hence the bounce in the final hours of trade.

As long as the area between 134.00 and 134.40 holds as new resistance on a daily closing basis (New York 5 pm EST close), I favor selling EURJPY strength. Key support for the week ahead comes in at 131.40.

Disclosure: I remain short from just above 136.60 and also added on Friday’s retest of former wedge support at 134.00.

The catalyst I mentioned above for the EURJPY applies to the GBPJPY. Even the similarities between the technicals are undeniable.

On Monday of last week I mentioned that the next leg lower was imminent. At the time the pair was sitting right at wedge support. Buyers managed to close prices above the support level on Tuesday, but it didn’t change my outlook.

The breakdown came just 48 hours after my initial commentary. Thursday’s spike following some hawkish rhetoric from the BOE presented a favorable selling opportunity.

That’s what I posted in the member’s area as the GBPJPY was on its way back down from 154.04.

Some may view that as a risky entry, but the asymmetric risk to reward and downside bias presented a clear selling opportunity in my book. And the fact that the pair had already traveled over 300 pips on the day meant that additional intraday strength was unlikely.

As long as 152.50/80 holds as new resistance on a daily closing basis (5 pm EST), I favor selling GBPJPY strength. Key support comes in at 149.35 followed by 147.00.

Disclosure: I remain short from 153.45 and will entertain additional entries should sellers follow through on last week’s movement.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Free Webinar: Learn how to trade pin bars, draw key levels, and much more!

[/thrive_custom_box]