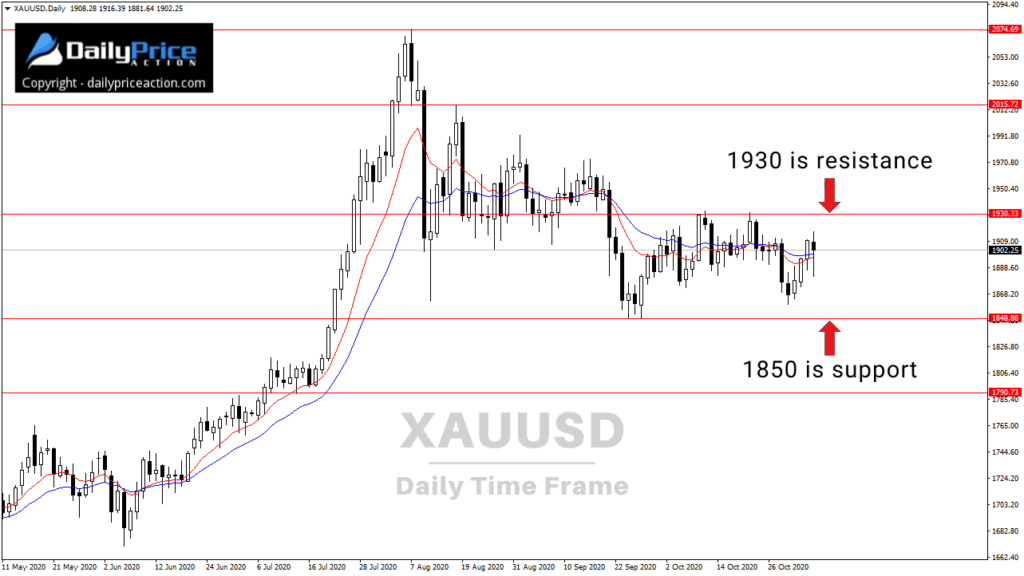

XAUUSD (gold) is pushing higher this week after consolidating since early August.

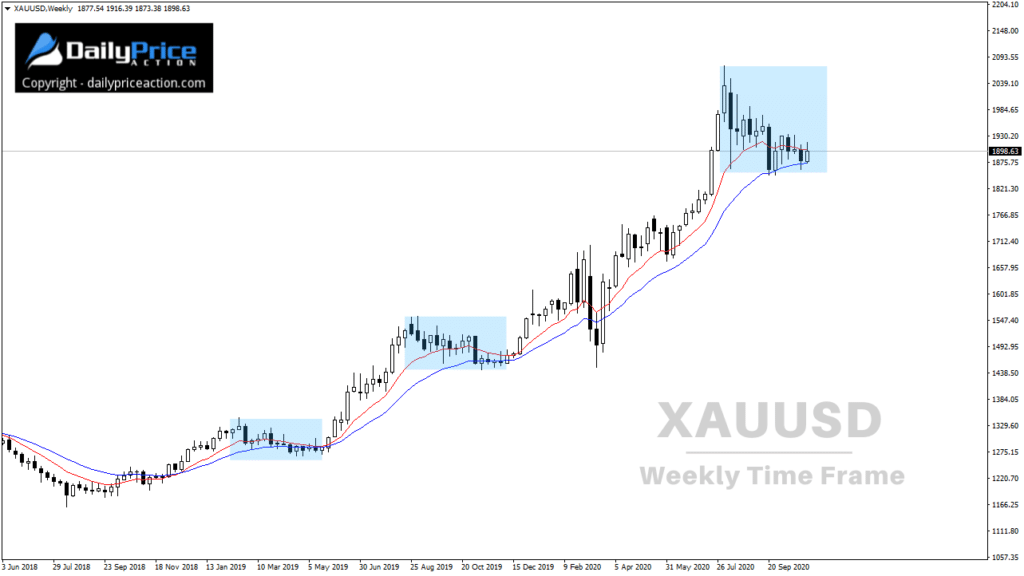

Despite the aggressiveness of that move lower from 2075, I’ve continued to like XAUUSD higher over the long term.

As I mentioned in last weekend’s forex forecast, this latest round of consolidation looks familiar.

We’ve seen gold do this before since the uptrend began in 2016.

Every round of consolidation has led to a higher high, and this time is no different, in my opinion.

XAUUSD is in the middle of a 10-year bull cycle following a four-year pullback between 2011 and 2015.

However, that doesn’t mean gold will break out this time.

We could see an exaggerated pullback into the 1790 support area, which served as resistance in 2011 and 2012.

Either way, I like gold higher in 2021.

I’m still treating it as an investment, particularly the junior gold miners that I bought back in April when the GDXJ was 28 (55 today).

I told Daily Price Action members about that investment in April.

As for XAUUSD, the pair needs to carve a higher high to confirm the break from consolidation.

That means it needs to close above 1930.

However, keep in mind that the US elections are ongoing and may not be over for some time.

That volatility could send XAUUSD lower before the next leg higher can materialize.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the XAUUSD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in November!

[/thrive_custom_box]