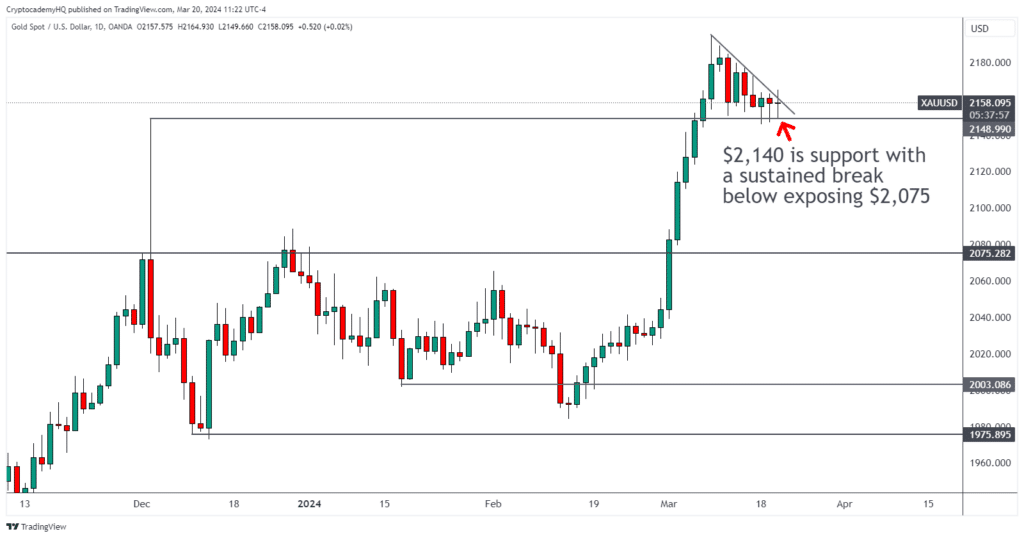

Gold remains sideways following the aggressive breakout to new all-time highs earlier this month.

However, the recent price action is a bit concerning for bulls.

In today’s video, I explain why this week’s price action from XAUUSD is a concern, key levels to watch following today’s FOMC, and possible targets.

[embedyt] https://www.youtube.com/watch?v=2ixtr6MSsBg[/embedyt]Gold recently surged to a new all-time high, clearing the December 4th failed attempt.

XAUUSD has also breached a 2011 ascending trend line that currently sits at $2,140.

However, despite the strength we’ve witnessed from gold bulls in March, the recent price action is a bit concerning for bulls.

Notice how XAUUSD has carved lower highs since bulls carved a fresh all-time high on March 8th.

Those lower highs wouldn’t be a concern if it weren’t for the $2,140-$2,150 support area that gold is pressuring this week.

To be clear, I don’t see XAUUSD as a viable short right now.

Any shorts taken at current levels would have to deal with the $2,140- $2,150 support region, not to mention today’s FOMC volatility.

That isn’t a great combination for managing risk.

Instead, it will take a sustained break below $2,140 on the higher time frames to confirm a fakeout and send gold back to $2,075.

A retest there isn’t guaranteed, but it would make sense from a liquidity standpoint, given the large imbalances following the March 1st and 4th candles.

Alternatively, a sustained break above the $2,195 high would suggest additional strength toward psychological levels like $2,250 and $2,300.

Want me to help you become a better trader? Join our VIP group for daily analysis videos, exclusive charts and setups, and see my trades in real-time! Plus, get the new video course that launches this month!