I first wrote about VeChain on June 26th.

At the time, the VET token was trading at $0.0088.

Even after all the ups and downs since June, VET is up about 100% and trading near $0.0164 at writing.

What are VeChain and VET, you ask?

VeChain is a public blockchain that’s solving real-world problems with big-name partners such as Walmart China, Deloitte, DNV GL, and many others.

VET and VTHO are the two tokens of the VeChain ecosystem.

VET is the store of value token, whereas VTHO acts as gas or energy to make transactions on the VeChain blockchain.

Before we get into the charts, I want to share something important with you.

In less than 24 hours, Decentralized is putting on a webinar with VeChain’s Dimitrios Neocleous to discuss developments in the healthcare industry.

We’re told that “exciting VeChain related news” will be announced, so you won’t want to miss it!

I’ll see you there!

As for the charts, things for VET have been relatively quiet in recent weeks.

The daily and intraday charts appear to be coiling for a big move.

The question is, will it be up or down?

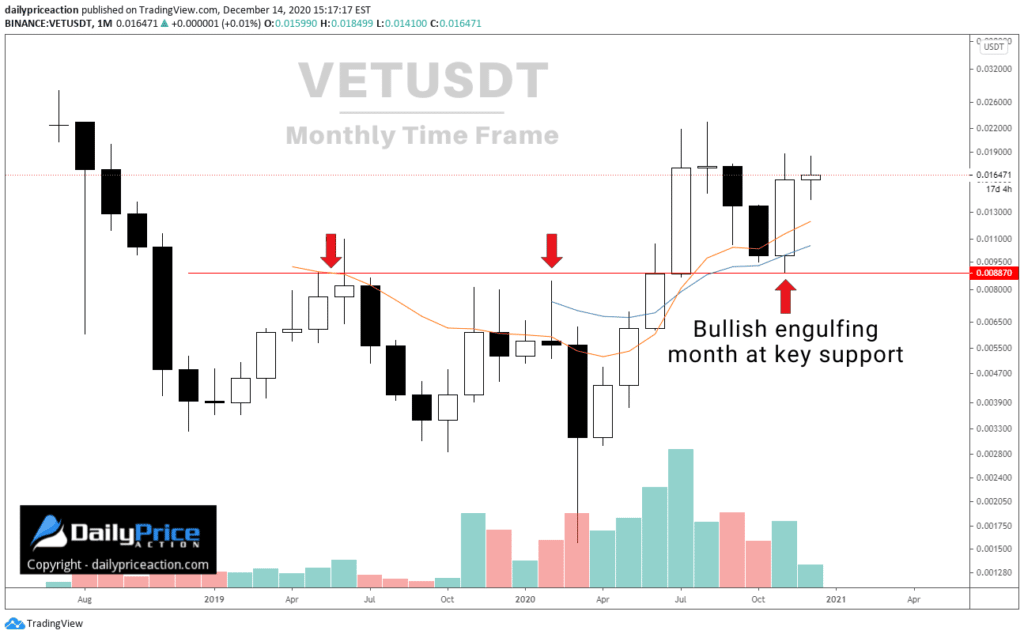

We’ll see, but the monthly time frame looks incredibly bullish.

November carved a bullish engulfing month from key support at $0.0088, suggesting a higher VET price in the coming months.

That isn’t surprising, given the cyclical crypto bull market that I wrote about on June 22nd.

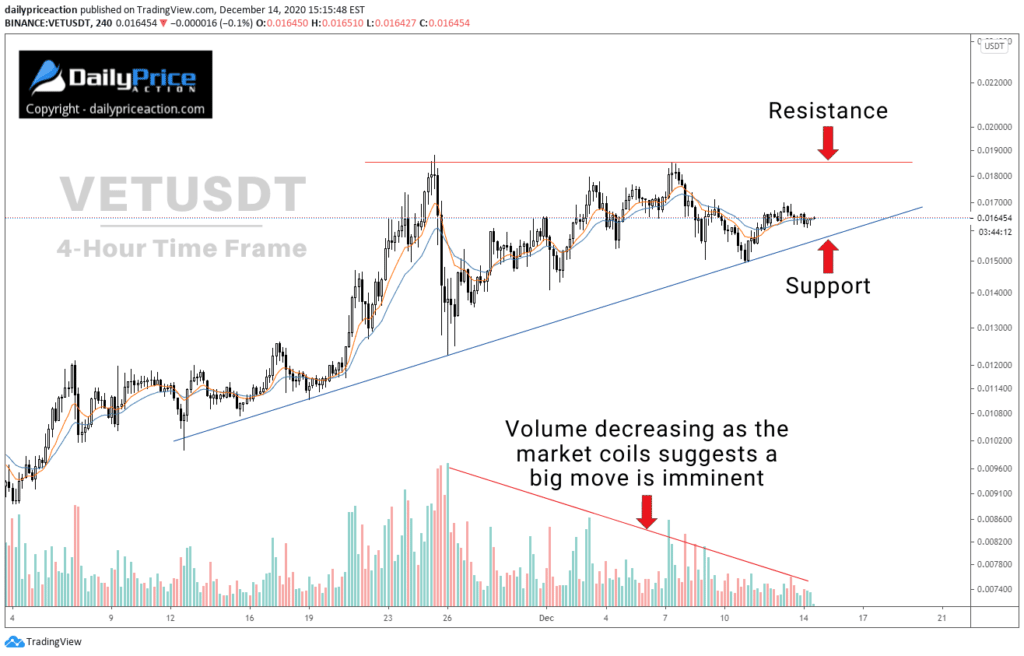

Looking at the 4-hour time frame below, VET has a decision to make within the next few days.

Either break higher above $0.0185 resistance or below $0.016 support.

A close above $0.0185 would expose $0.022, whereas a break below $0.016 would open the door to the $0.014 to $0.015 region.

What’s interesting is how volume has tapered off during this consolidation.

That indicates, at least to me, that VETUSD is on the verge of a big move.

Either way, I’m staying long VETUSD well into 2021 and will continue to treat dips as buying opportunities.

Last but not least, don’t forget to register for tomorrow’s webinar to be the first to hear the exciting VeChain news.

Register here:

Disclosure: I hold a VETUSD long position.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the VETUSD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in December!

[/thrive_custom_box]