I have been bearish on NZDJPY since the start of the new year. The multi-year high made in December of last year was telling, to put it lightly, that the two-year rally was likely coming to an end.

How did I determine that? Let’s just say I’m glad Fibonacci studied what he did.

But after a 1,000 pip decline since April, we would expect some type of meaningful rally. And while we have seen some relief rallies along the way, none of them have gained enough traction to be considered meaningful.

Another way of saying the above is that the pair continues to look weak at current levels. A great example is the price action on July 23rd. The pair rallied 65 pips above the key 82.20 level intraday but was unable to hold on to these gains, closing the day 100 pips below the high.

This tells me that smart money is not booking profits just yet, and I know why, at least from a purely technical standpoint.

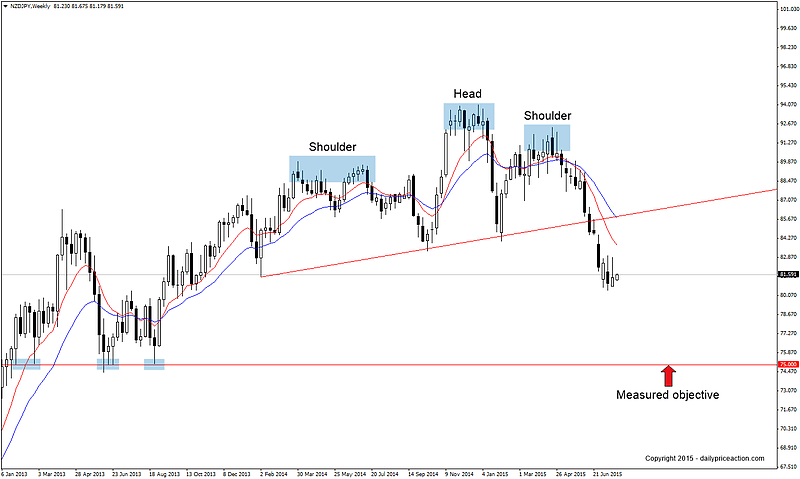

If we look at the weekly chart we can see a large head and shoulders reversal that formed between February of 2014 and June of 2015.

Notice in the chart above that the measured objective for the pattern comes in at 75.00, a level that lines up with several lows from 2013. This could be the major reason why smart money has decided to hold short, fundamentals aside of course.

Let me be clear, this does not mean that the pair won’t rally higher from here. However I do believe that any rallies will be short-lived given the broader bearish momentum that continues to drive the market combined with the measured objective that has yet to be satisfied.

So what is the plan moving forward?

From here we can use the 80.45 level as a trigger to either initiate a new short position or add to existing exposure, which is the case for myself and many DPA members. This level can be seen acting as support and resistance during 2013 and is also the current low for 2015.

Summary: Wait for a daily close below 80.45 and then watch for a selling opportunity. Key support comes in at 79.30, 78.50 and 77.50 with a longer-term measured objective at 75.00.