On November 13, I wrote about how an NZDCAD bullish scenario might unfold.

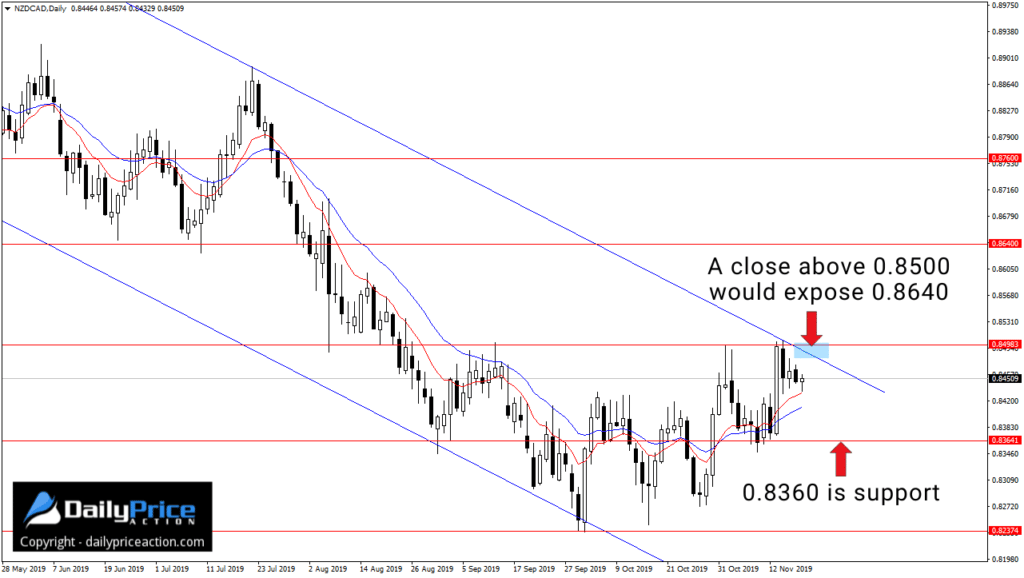

In my opinion, it would have to start with a daily close above 0.8500.

It’s a confluence of resistance based on the intersection of a key horizontal level from August and descending channel resistance from March.

That would likely open the door to the next key resistance at 0.8640.

Of course, none of that has happened just yet.

But I do think NZDCAD is one worth keeping an eye on just in case as the risk to reward could be well worth it, in my opinion.

The fact that the New Zealand dollar is staying constructive against the USD is another reason NZDCAD remains on my watchlist.

I wrote about the NZDUSD last Friday.

Although the potential inverse head and shoulders there hasn’t been confirmed, buyers aren’t backing down.

I see that as a sign of strength from the kiwi.

If a pair like the NZDUSD can make good on that bullish reversal pattern, it would only help solidify the rally efforts from NZDCAD bulls.

Just remember that NZDCAD buyers need to secure a daily close above 0.8500 for the pair to rally regardless of what the NZDUSD does.

I also dislike the idea of selling the NZDCAD at resistance.

Even if the pair carves a bearish pin bar or engulfing candle, I won’t be interested in selling.

There are two reasons for that.

The first is that the pair is coming off the multi-year support at 0.8280.

I wrote about this on November 13.

Second, the sideways movement since November 13 hints at strength as buyers are refusing to back down from the 0.8500 confluence of resistance.

It doesn’t guarantee a move higher, but it does make me second guess trying to sell this market.

Whether buyers or sellers take control, though, I have to favor the clean technicals, especially when so many other currency pairs remain indecisive.

That alone secures a spot for NZDCAD on my watchlist.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the NZDCAD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in November!

[/thrive_custom_box]