On November 6th I wrote that the future direction for EURUSD hinged on 1.1430. You can see how the single currency has pivoted from this area in recent months.

The very next day on November 7th, buyers took the price to a session high of 1.1500. But they failed to close the pair above 1.1430 at the 5 pm EST close.

If your chart looks different than mine, it’s probably because you aren’t using a New York close. You can go here to get access to the same charts I use.

Last week, I wrote about the November 7th close and how it might trigger a move lower. Sure enough, EURUSD sold off on Thursday and again on Friday.

It isn’t just the daily time frame that looks bearish either. A view from the weekly chart shows a 180-pip bearish pin bar. And that candlestick compliments the downward momentum that began in April.

So where to this week?

Judging by the final 48 hours of last week, it seems euro bears are intent on retesting 1.1300 support this week. However, don’t be surprised if buyers put up a good fight here.

That said, it’s my opinion that a daily close below 1.1300 is only a matter of time. Usually when a market begins to pressure an area like this, a breakout isn’t far away.

As I mentioned last week, a daily close below 1.1300 would expose the next key support at 1.1130. Alternatively, a bounce from 1.1300 could take us back to 1.1430 resistance, but I’d be surprised to see that kind of bid materialize this week.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each day closes at 5 pm EST.

Click here to get access to the same charts I use.

[/thrive_custom_box]

GBPUSD began last week on a bullish note. The daily price action between Monday and Wednesday was positive with total gains of 160 pips.

However, that came to an abrupt end on Thursday.

Not only did the pound give up all of Wednesday’s gains, but sellers also closed the pair back below the 1.3070 key level.

You may remember this level from last Sunday’s commentary. At the time, I highlighted 1.3070 as resistance. That means it should’ve attracted buyers during Thursday’s retest of the level as new support.

But that didn’t happen. Instead, we saw Friday’s session reach a high of 1.3070 before plummeting 100 pips before the weekend.

I wrote about the potential of a weekly sell signal on Friday. The main takeaway from that post was that GBPUSD has been consolidating since August.

Here’s why that matters:

The GBPUSD is off its year-to-date high by a considerable 1,400 pips. And despite rallying in early September, the pair has done nothing but move sideways in a 570-pip range.

So we have a downtrend followed by sideways movement. That sounds more like a bearish continuation pattern than a market that’s ready to move higher.

For the week ahead, key resistance comes in at 1.3070. Support, on the other hand, is down near 1.2800 followed by 1.2700.

One last thing:

Markets love to retrace 50% of weekly signals like the pin bar. If you draw your Fibonacci tool across last week’s range, you’ll quickly notice that the 50% level lines up with 1.3070.

A mere coincidence or a clue? We’ll soon find out.

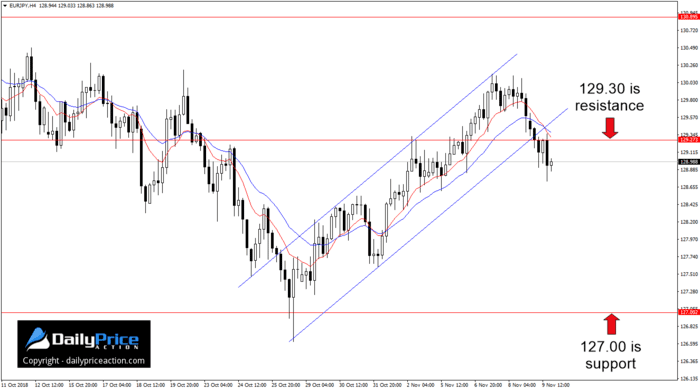

EURJPY may be gearing up for a move lower this week.

I wrote about two requirements for a bearish scenario on Thursday of last week. Within 24 hours, EURJPY had satisfied both requirements.

The first was that 130.00 resistance needed to hold.

The theory was that a move above this point would be more than 50% of the recent decline. Most corrections stay somewhere around that 50% area before rolling over.

Requirement number two was a close below the 4-hour ascending channel.

Sellers satisfied that requirement on Friday. EURJPY broke channel support and remained under pressure heading into the weekend.

So what’s the game plan?

Pretty straightforward, really. Sellers will most likely defend the 129.30 resistance area if tested. That could present a selling opportunity depending on your criteria.

Key support comes in down near the 127.00 handle. However, keep a close eye on 128.30 as well. Move to the daily time frame to see why.

Lastly, EURJPY carved a bearish pin bar on the weekly time frame. Until proven otherwise, that’s another indication that the risk-sensitive pair will likely remain under pressure this week.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Advanced Forex Webinar: The 7 Secrets of Consistent Forex Profits

[/thrive_custom_box]

I’ve received a lot of questions about GBPJPY lately. I held off on posting about it for one simple reason:

There wasn’t much to talk about until now.

Last Tuesday closed above descending channel resistance near 148.40. But I wasn’t going to be a buyer given that the market is still dealing with the May 23rd break of ascending channel support.

Furthermore, the 149.30 resistance area has capped every advance since July including last Thursday’s rally.

Despite all of that, I was waiting to see if sellers could close the pair back inside this descending channel from the year-to-date high.

GBPJPY bears came through on Friday. The 147.65 close puts the pair below the channel ceiling near 148.20.

That leaves us waiting to see if the pair can retest 148.20 as new resistance this week. If so, it could present an opportunity to get short for a move to the 147.00 support area.

This one may need additional confirmation though. For that, we can watch to see if bearish price action forms near the 148.20 resistance area.

It seems Gold may be heading lower this week after all. I mentioned gains might be limited last Monday due to a confluence of resistance near 1235.

Sure enough, the 1235 resistance area held up all week. Then on Wednesday, sellers decided to take the market lower and never looked back.

You may recall the other key level from last Monday’s post was 1215. It’s the horizontal level that allowed buyers to extend gains in mid-October.

The 1215 level also held up during the rather aggressive October 31st retest and subsequent November 1st bounce.

But all that changed with Friday’s close. Friday’s final print of 1209 puts gold below the 1215 key level. That means any retest of it this week will likely attract an influx of selling pressure.

Not only that, but the market edged closer to ascending channel support that extends from the year-to-date low. I pointed out this pattern on Monday of last week.

But here’s the question that should be on everyone’s mind:

Is this short-term ascending channel something more significant and telling? Perhaps a bearish flag pattern?

It would be difficult to argue that it isn’t. A look at the price action since April shows a gold market that’s well off its year-to-date high.

Furthermore, July’s move below 1235 took out the December 2017 swing low. That’s significant because, before that move below 1235, gold had been trending higher since December 2016.

In other words, July’s plunge took out a multi-year uptrend.

Throw this latest ascending channel into the mix, and you have a bearish recipe that’s impossible to ignore.

As for this week, sellers will likely look to defend 1215 as new resistance. But in order to see gold much lower, bears will need to take out channel support near 1200 on a daily closing basis.

This is when it’s crucial that you’re using a New York close chart like the ones offered here. Otherwise, you’re exposing yourself to false breakouts.

Now, if buyers beat the odds and secure a daily close back above 1215, we could see gold march higher toward 1235 resistance. That isn’t the base case in my view though.

The most likely scenario, in my opinion, is a decline to channel support near 1200. A daily close below that would open up the October lows at 1180 followed by the year-to-date low at 1160.

I’ll be keeping a close eye on gold as the price action within this channel unfolds. If the market treats this as a continuation pattern, the objective would be, well, a very long way down.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each day closes at 5 pm EST.

Click here to get access to the same charts I use.

[/thrive_custom_box]