Markets are slow this week due to a relatively light event calendar, but that doesn’t mean there aren’t quality trade setups.

Check out today’s mid-week outlook to see how I’m trading the DXY, EURUSD, GBPUSD, and XAUUSD.

US Dollar Index (DXY) Outlook

The DXY is breaking down today following Friday’s NFP selloff. As discussed over the weekend, Friday’s move put the DXY back below 99.35, confirming a buy-side fakeout.

The failure to hold 99.35 as support opened up 98.50, and the imbalances between 97.74 and 97.93. However, the dollar first needs to break below the 98.50 region to expose those lower levels.

If the DXY holds above 98.50 on Wednesday, we may see bulls target the 99.35-99.50 resistance area. But as mentioned in recent videos, I’m only interested in US dollar shorts this week following last week’s breakdown.

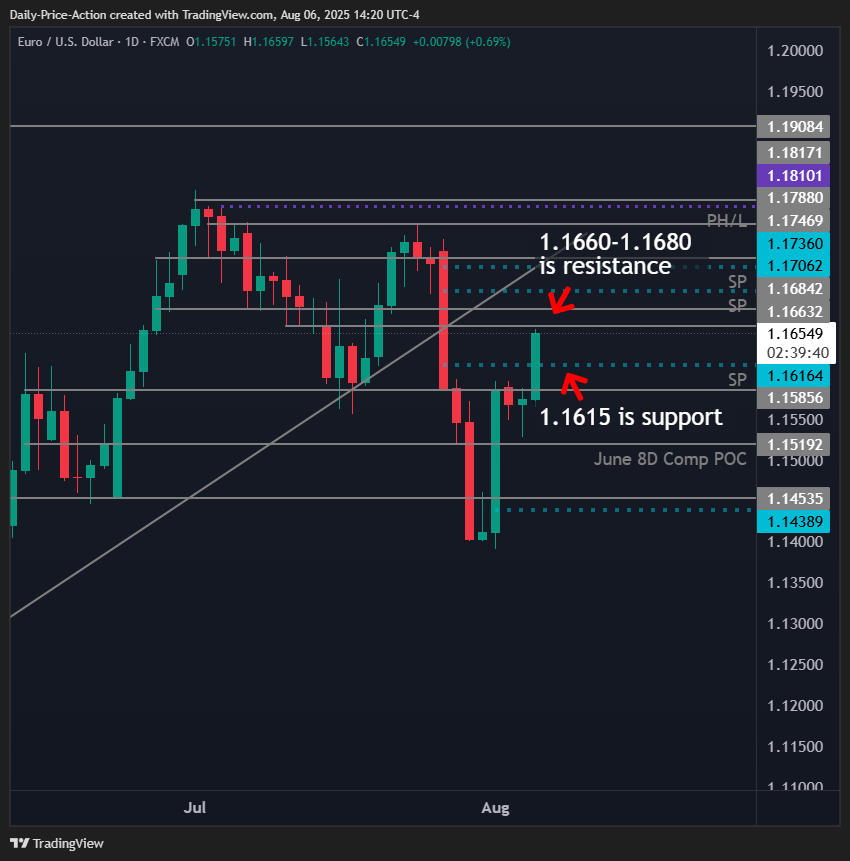

EURUSD Outlook

EURUSD is rebounding this week following last week’s bullish reclaim of 1.1450. Tuesday’s session tested the 8-day composite POC I mentioned in recent videos at 1.1520 before rallying above 1.1585 on Wednesday.

So far, both the DXY and EURUSD have “filled” imbalances from July 28th. The question now is, will Wednesday’s session close above 1.1585?

If yes, the EURUSD buy-side imbalances at 1.1706 and 1.1736 become targets. If no, 1.1585 will remain resistance with support at 1.1520.

As mentioned recently, a rounded retest of the March trend line in the 1.1740 region seems likely. Bulls didn’t put up much of a fight in late July, which means some imbalances may need to be “cleaned up” before further downside is expected.

GBPUSD Outlook

GBPUSD also reclaimed a significant level on Friday. The 1.3240 region I discussed in recent videos is a key horizontal level from April and the bottom of a descending channel from July 1st.

That reclaim opened the door to buy-side imbalances, including 1.3340, which GBPUSD reached on Wednesday. However, two more imbalances remain just above the 1.3385 resistance area, closer to 1.3398.

Sellers will look to defend the 1.3400 region on a retest. Still, the descending channel resistance from July could become a factor. That’s especially true if the DXY tests the 97.70 area in the coming days.

XAUUSD (Gold) Outlook

Gold is following through on the bullish reclaim at $3,285. I mentioned this as a potential buy signal on XAUUSD to VIP members on July 31st.

The $3,404 imbalance, combined with the long upper weekly wick from three weeks ago, is serving as a magnet for gold this week. However, gold bulls face a significant test in the $3,400-$3,430 range.

As long as gold remains below $3,430 on the high time frames, the range-bound conditions will continue. We also have a sell-side imbalance at $3,305 that could become a factor later this month.