What a start to the year for global financial markets. With the Dow and S&P both selling off to tune of 6% or greater, it’s no surprise that we saw several currency pairs move in lockstep.

Unlike other currencies that are matched against the US dollar, the Euro managed to make up some ground last week after falling below the 1.0820 handle. How much further it can climb is still anyone’s guess at this point.

Judging by Friday’s price action, further upside in the coming sessions isn’t out of the question. However, I still don’t like the idea of betting against the US dollar, especially with the pair still trading below former channel support from 2015.

From here traders can watch for a selling opportunity on a retest of the 1.1020 resistance level. A close above it would expose former channel support near 1.30. On the flip side, a move back below support at 1.0820 would expose the 1.0660 support level.

GBPUSD continues its search for solid ground. The pair has now slipped 1,400 pips since the 2015 top was carved out at 1.5930.

It’s hard to believe that last Friday’s close has exposed lows from 2010, which formed just two years after the global crisis that wreaked havoc on financial markets. But that’s exactly what has happened with last week’s close falling below the 2015 low at 1.4565, which opens the door for a move to the 1.4225 key support level.

From here traders can watch for a selling opportunity while the pair trades below the 1.4565 handle on a closing basis. Key support comes in at the 2010 low of 1.4225.

NZDUSD represents what is arguably the most favorable trade setup going into the new week. Of course if the kiwi breaks down from current levels, chances are several of the other currency pairs in today’s commentary will follow suit.

From a risk to reward perspective, however, NZDUSD is at the top of the list after Friday’s price action gave us a convincing close below former confluent support at 0.6620. I mentioned this area last week as one to watch, not so that we could buy on a pullback to support, but rather to sell on weakness.

From here traders can watch for a selling opportunity as long as the pair trades below the 0.6620 handle. Support levels to the downside are just as easily identified at 0.6430 and 0.6240, which is near the 2015 low. A break there could see a much larger decline materialize over the coming weeks and months.

AUDUSD didn’t disappoint sellers last week after the pair closed below four-month trend line support. What was lacking, however, was a retest of former support as new resistance.

The good news for those who still carry a bearish bias here is that I don’t believe this selloff has reached its limit. In fact, I think it’s just beginning.

Last week I pointed out the descending channel that has been in place since October of 2014. In that same commentary, I also noted that the 0.6250 handle, which marks the 2009 low, lines up suspiciously close to what could eventually be channel support.

While a 700 pip move lower may seem lofty, I don’t think anyone will argue that these markets are primed for big moves having witnessed last week’s price action.

To the downside, key support comes in at the 2015 low at 0.6910 as well as the 0.6800 handle. Any rallies from here should be capped by former trend line support near 0.7140.

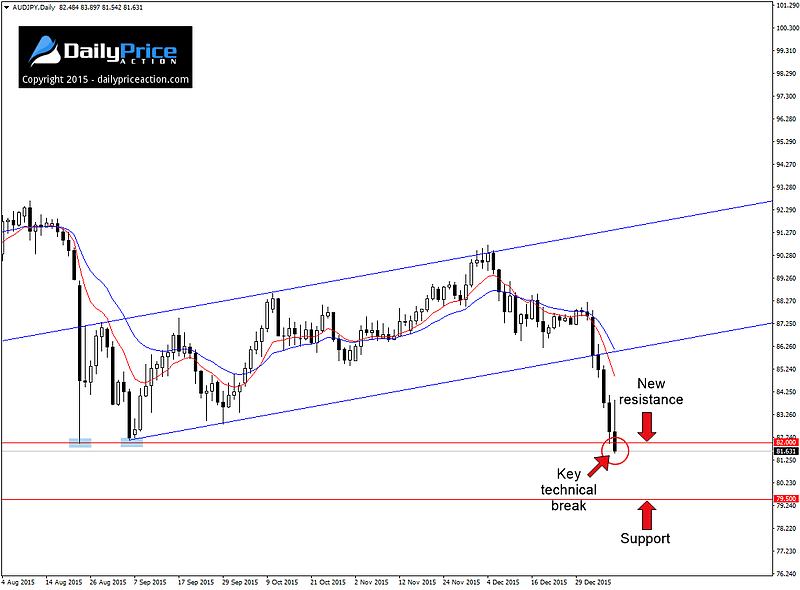

Unsurprisingly, AUDJPY has shared similar movement to its AUDUSD counterpart as it has also been under considerable pressure of late. However, due to its relation to the Japanese yen, it has seen a much greater level of selling pressure than that of the Australian dollar versus the US dollar.

I have written previously about the yen as a safe haven currency and last week was a prime example of that dynamic at work. For that reason alone, I will continue to favor the yen pairs above all others in terms of downside potential.

As for AUDJPY, the pair ended last week below the 2015 low at 82.00, signaling that further weakness is likely in the coming sessions. Any attempted rally from current levels will likely be stunted by the former multi-year low.