Everyone seems to want to short GBPUSD in anticipation of a failed Brexit deal.

At least that was the case last week.

But that kind of herd mentality rarely plays out as expected.

And if I look at the charts, I can see why the bearish scenario may backfire, especially when viewing the higher time frames.

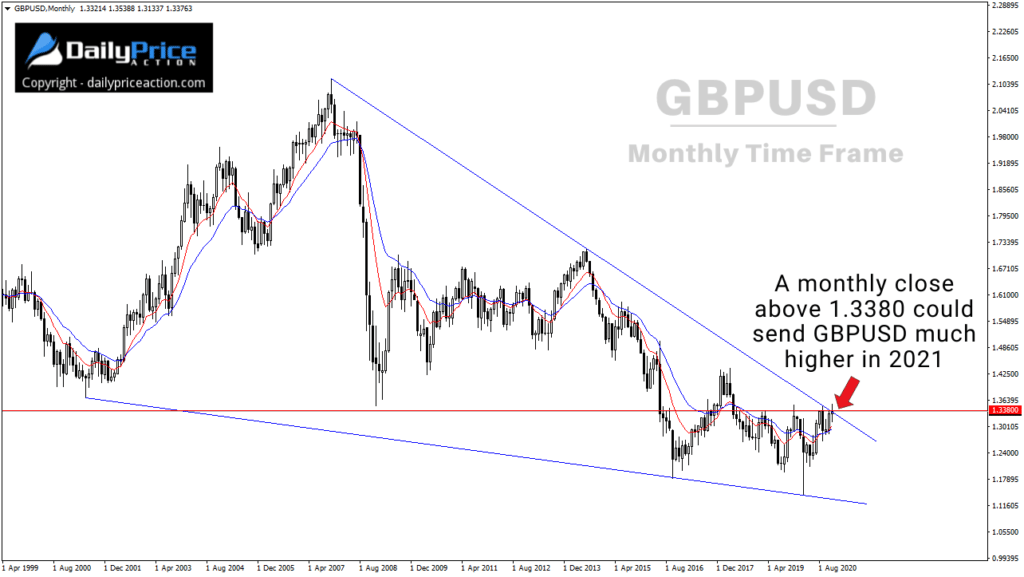

I’ve mentioned the GBPUSD multi-decade falling wedge several times on this website, but it’s worth revisiting.

As I mentioned in Saturday’s forex forecast, if GBPUSD can close this month above 1.3380, it could send the pound much higher in 2021.

On December 3rd, I even wrote that a GBPUSD breakout from the multi-year structure above could target 1.45.

However, buyers need to secure a monthly close above 1.3380 first.

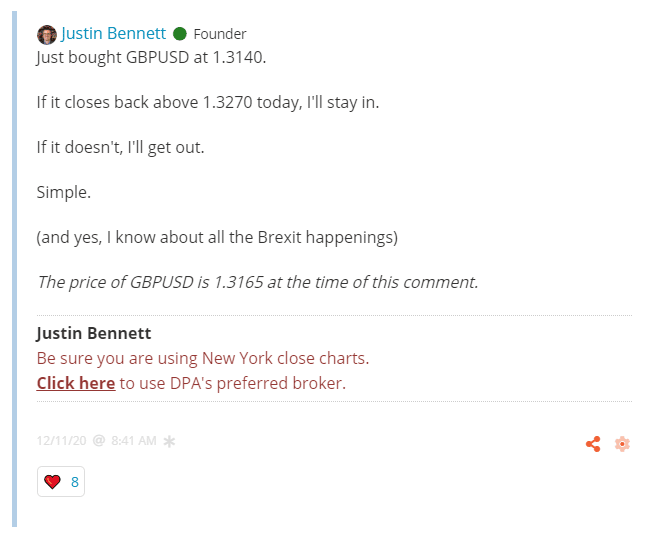

As Daily Price Action members know, I bought GBPUSD on Friday at 1.3140.

Here’s what I wrote in the member’s area:

I exited that trade before the weekend for a 77 pip gain.

As it turns out, the weekend gap would have been in my favor.

Where the GBPUSD goes from here depends heavily on the next Brexit headlines.

That said, the descending channel below could offer some hints from a technical perspective.

If GBPUSD closes a day above 1.3420 or so, it could expose 1.3680.

Just keep in mind that the pair has to get above 1.3480 and close a month above 1.3380 to confirm the breakout from the multi-year falling wedge.

There are many technical factors at play for GBPUSD, but most of them point to a move higher in 2021.

Last but not least, anyone trading the pound should expect continued volatility as the battle of Brexit rolls on.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the GBPUSD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in December!

[/thrive_custom_box]