GBPCAD pulled back in December but has trended higher overall since September.

However, bulls clearly struggled at the 1.6770 macro resistance last month.

That’s no surprise, given that 1.6770 supported GBPCAD for most of 2020 and 2021.

But even if GBPCAD has topped out, a partial retracement of December’s pullback seems likely based on the recent price action.

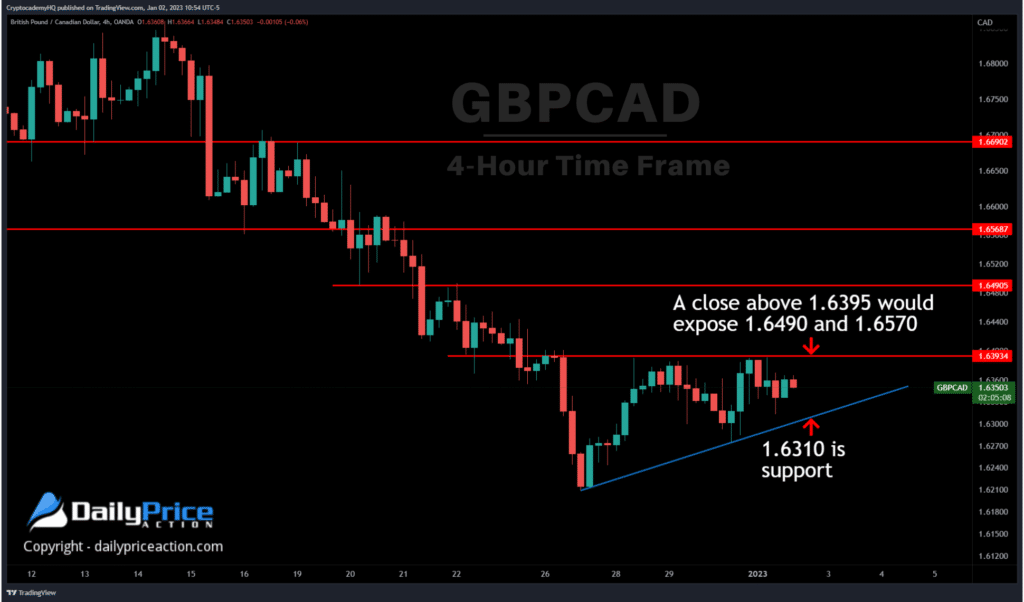

Although it isn’t confirmed yet, the potential ascending triangle on the 4-hour chart below looks promising for bulls.

A 4-hour and daily close above 1.6395 should confirm the breakout.

From there, the first target will be 1.6490 with a measured objective of 1.6570.

That gives longs a potential profit of 180 pips if GBPCAD can break to the upside.

But as always, we must respect the potential for a breakdown instead.

I’d like to see GBPCAD stay above Friday’s low at 1.6275 to remain constructive. Anything below that, and things could get ugly again.

In summary, a bullish breakout from GBPCAD above 1.6395 would be attractive toward 1.6490 and potentially 1.6570.

Alternatively, a break below 1.6275 would be bearish for GBPCAD and expose the 1.6200 area.