In this weekly Forex forecast, I’m going to show you exactly how I’m trading EURUSD, GBPUSD, EURAUD, BTCUSD, and ETHUSD through January 15, 2021.

Watch the video below, and be sure to scroll down to see the charts and key levels for the week ahead.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Did You Like That Video?

Subscribe on YouTube to get notified when I post new videos every week!

[/thrive_custom_box]

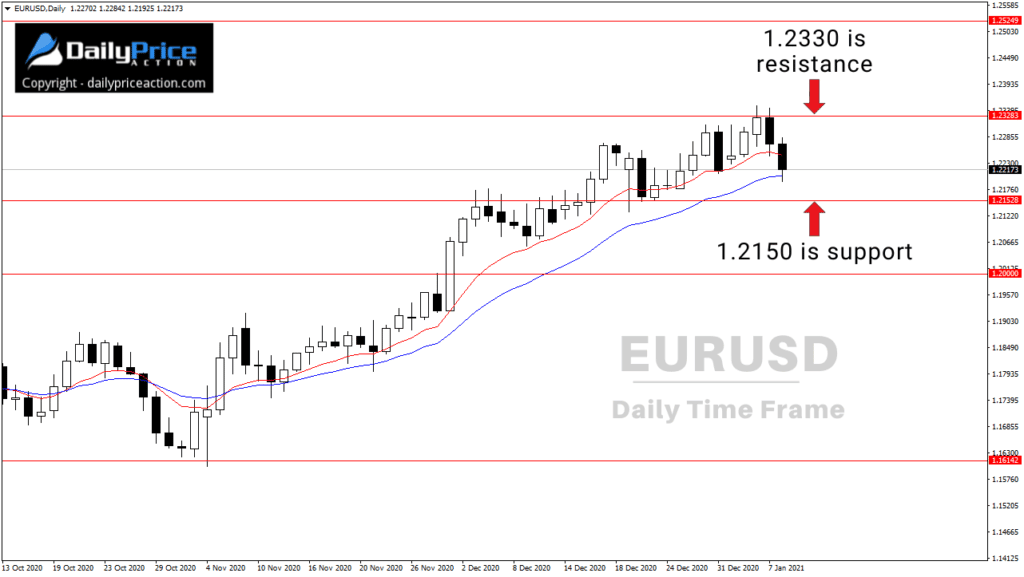

EURUSD Technicals

The EURUSD was mostly sideways last week after failing to close above the 1.2330 resistance area.

It previously looked like 1.2300 was the level to break, but the market told us otherwise on Thursday.

For now, the 1.2150 area remains support.

EURUSD bulls need to secure a daily close above 1.2330 to open the door to my target at 1.2500.

That’s a target I’ve discussed since October.

A failure to hold above 1.2150 on a daily closing basis would expose lower levels, perhaps even 1.2000.

Disclosure: I hold a EURUSD long position.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want Me To Help You Become A Better Forex Trader?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in January!

[/thrive_custom_box]

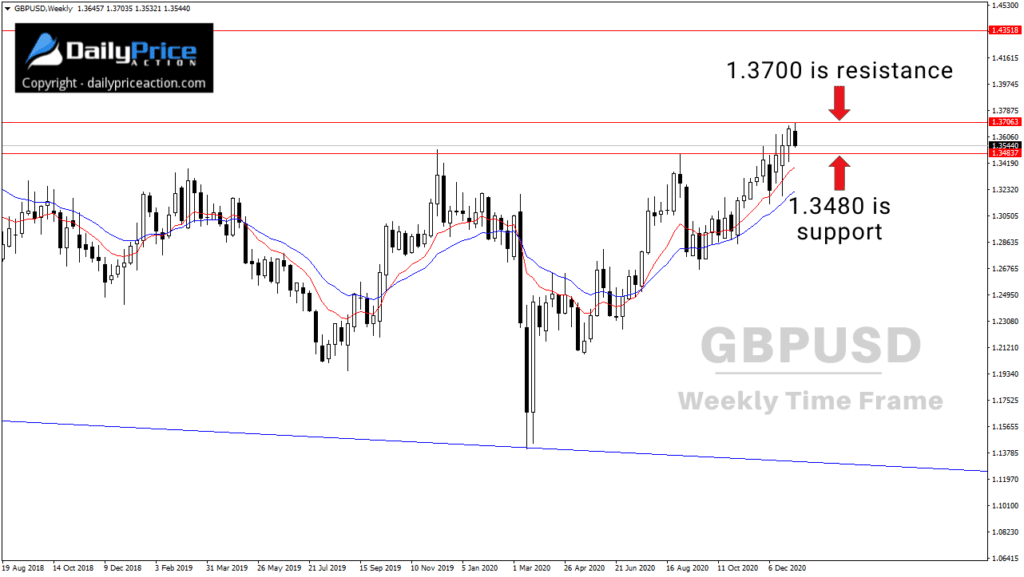

GBPUSD Technicals

I wrote about the GBPUSD on Friday.

The pair is holding above the 1.3480 area on a weekly closing basis, which is relatively bullish.

However, GBPUSD bulls need to climb above the area between 1.3700 and 1.3800 to expose higher levels.

Do that, and we could see the pair trend higher toward 1.4350.

Alternatively, a weekly close below 1.3480 would delay the bullish outlook.

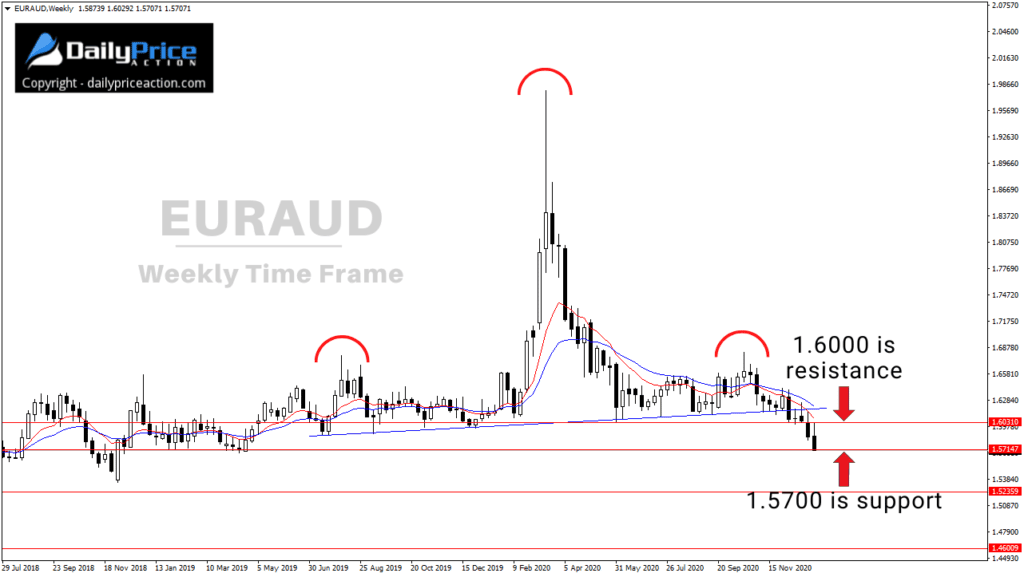

EURAUD Technicals

I wrote about this EURAUD breakdown on December 19th.

Fast forward to today, and any shorts taken in the 1.6150 resistance area are in profit by over 400 pips.

That said, I do expect buyers to defend the 1.5700 area this week.

If they don’t and EURAUD closes below 1.5700, the 1.5200 region is next.

But as I’ve said for weeks, if the pair plays out per the head and shoulders pattern below, 1.5700 and even 1.5200 may only be the start.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want FREE Lifetime Access to the Daily Price Action Member’s Area?

GET ACCESS Today!

[/thrive_custom_box]

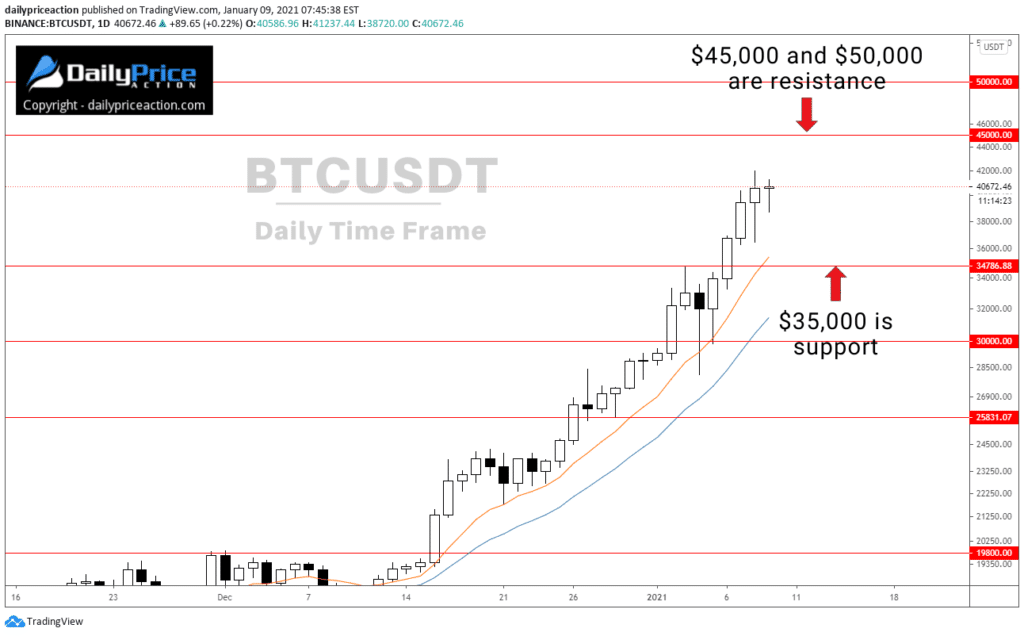

BTCUSD Technicals

Bitcoin (BTC) has had an incredible run over the past few months.

And that’s an understatement.

As many of you know, I first wrote about Bitcoin on May 5th, 2020.

The cryptocurrency was trading at $8,800 when I wrote that post.

Fast forward to today, and BTC is trading above $40,000.

I even told Daily Price Action members that I was accumulating Bitcoin around the $7,000 mark in April of last year.

Bitcoin is up nearly 500% since then.

In the near-term, any pullback will likely find support around $35,000.

As for resistance, the $45,000 mark may attract sellers, but given where Bitcoin is today, $50,000 is well within reach.

Disclosure: I hold a BTCUSD long position.

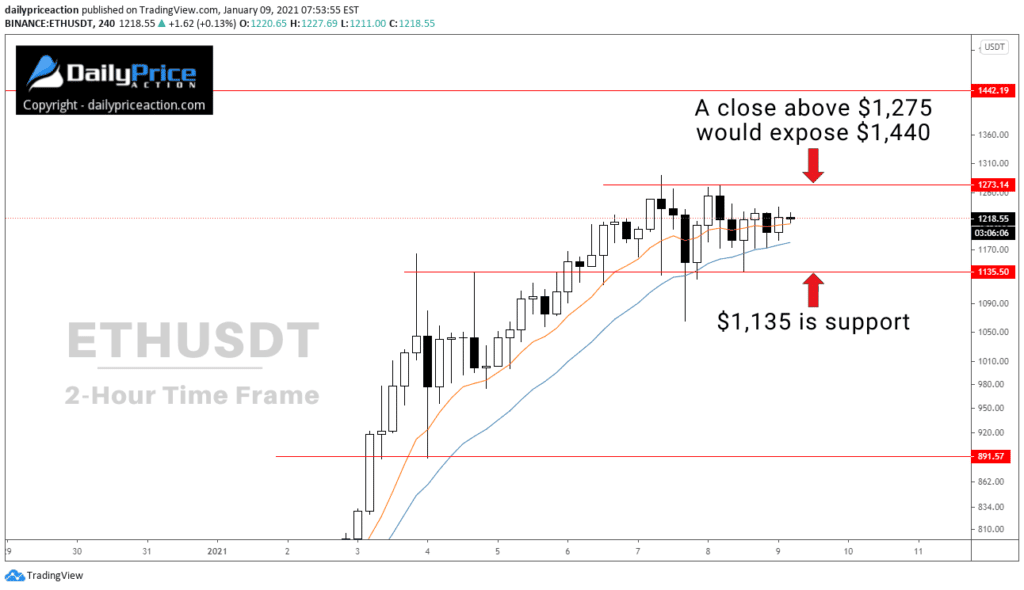

ETHUSD Technicals

Like Bitcoin, I started buying Ethereum (ETH) toward the middle of 2020.

At the time, Ether was trading between $200 and $240.

Fast forward to today, and the crypto is up a massive 430%.

As impressive as they’ve been, the rallies from cryptocurrencies like Bitcoin and Ethereum are far from over, in my opinion.

Ethereum hasn’t even broken above its all-time high near $1,440.

Once that happens, ETH enters price discovery.

And in my opinion, ETH is just days away from retesting $1,440.

Disclosure: I hold a ETHUSD long position.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want Me To Help You Become A Better Forex Trader?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in January!

[/thrive_custom_box]