The EURUSD has been a challenging pair to figure out this month.

At first, it looked like the euro was respecting a trend line from the May 2020 lows.

However, the last few days have shown that that trend line may not be so significant after all.

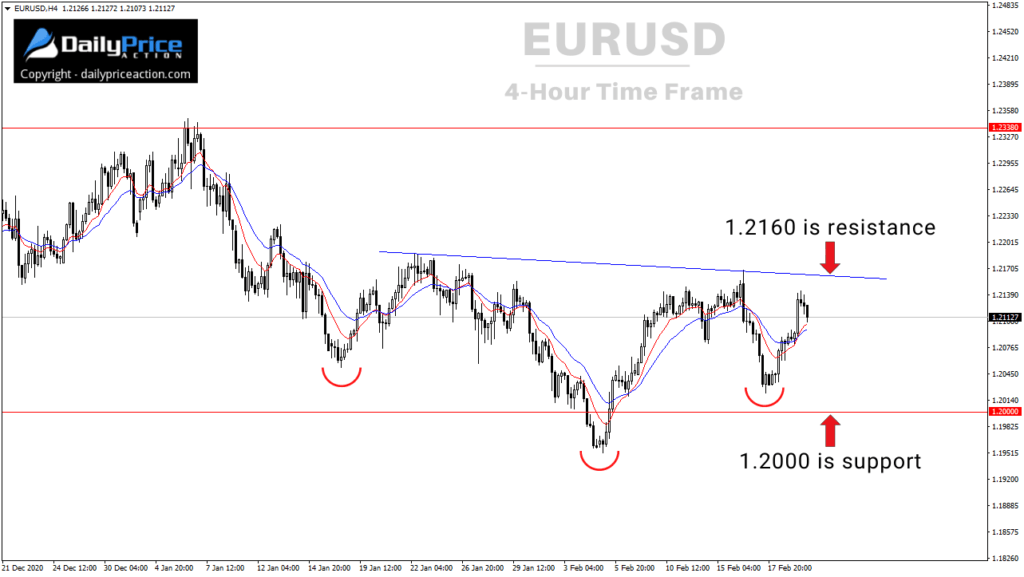

That said, I still believe the 1.2000 handle is key for the EURUSD.

The recent false break below that level suggests an increase in demand for the euro, which should translate to higher prices.

So far, it has the pair trading about 90 pips higher.

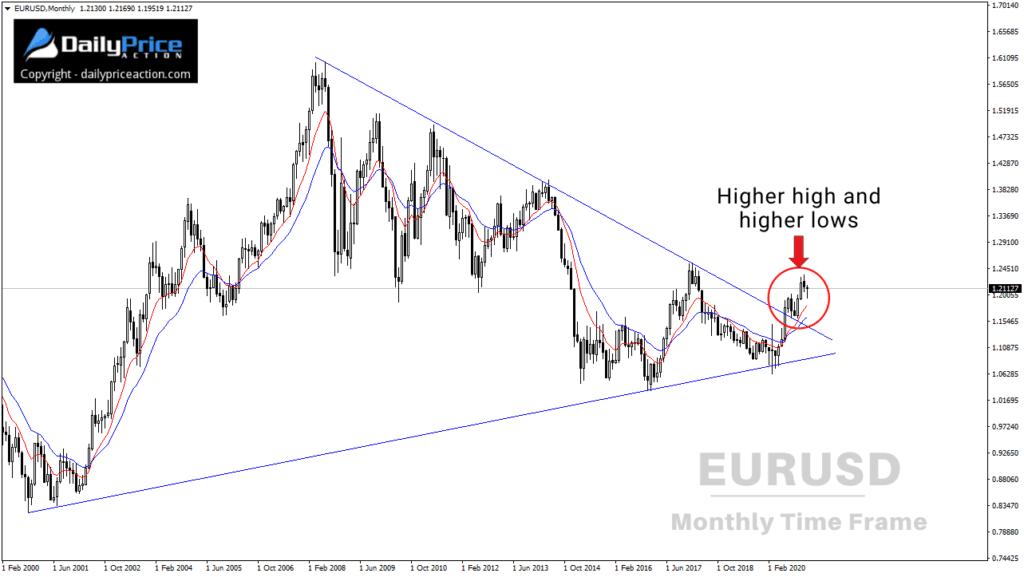

In case you missed recent articles, the reason I’m staying bullish on the EURUSD has to do with the higher time frames.

The euro continues to carve higher highs and lows after the July 2020 breakout from a multi-year level.

That alone has me looking for long positions and nothing else.

In addition to the early February false break below 1.2000, the EURUSD may be carving an inverse head and shoulders.

The pair is just now coming back to test the neckline near 1.2160.

It’s going to take a close above that area to confirm the inverse head and shoulders and open the door to higher prices.

One such level is 1.2330.

That’s the euro’s year to date high, and will surely attract sellers on the way up.

The measured objective of the pattern below, if it ends up confirming, comes in right around 1.2400.

Alternatively, a daily close back below 1.2000 would negate the bullish outlook.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the EURUSD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in February!

[/thrive_custom_box]