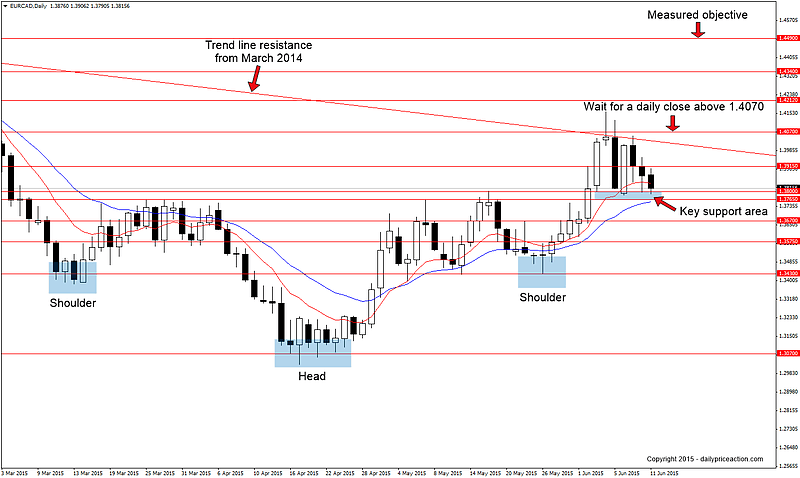

We have been focused on EURCAD for some time now. At first it was the wedge pattern that had formed in late April which gave way to a 500 pip rally. Little did we know at the time that this move would go on to carve out the second shoulder of a much larger inverse head and shoulders pattern.

Not long after the pair broke the neckline on June 2nd which triggered a 380 pip rally that would test trend line resistance from March of 2014. Since that time, however, the pair has struggled to gain the bullish momentum necessary to take out this area of increased supply.

This brings us to an interesting juncture for EURCAD. As I type this the pair is once again testing the key support area that lies between 1.3765 and 1.3800. This area represents the neckline for the reversal pattern and has already acted as support on several occasions this week.

It’s now make or break time for the Euro versus the Canadian dollar. A daily close below the aforementioned support area would expose the next key support at 1.3670. Of course in order to salvage the inverse head and shoulders the support area must hold on a daily close basis.

Alternatively, and more favorably for the bulls would be a break back above 1.3915. This would once again expose the fourteen-month trend line. A break there would open up the door for further gains and ultimately expose the measured objective at 1.4490.

Summary: Wait for a daily close above the 1.4070 key level which would open up the door for further gains. No interest in a short here given the three-month bullish reversal pattern that is still in play.