The AUDUSD is at risk of breaking lower.

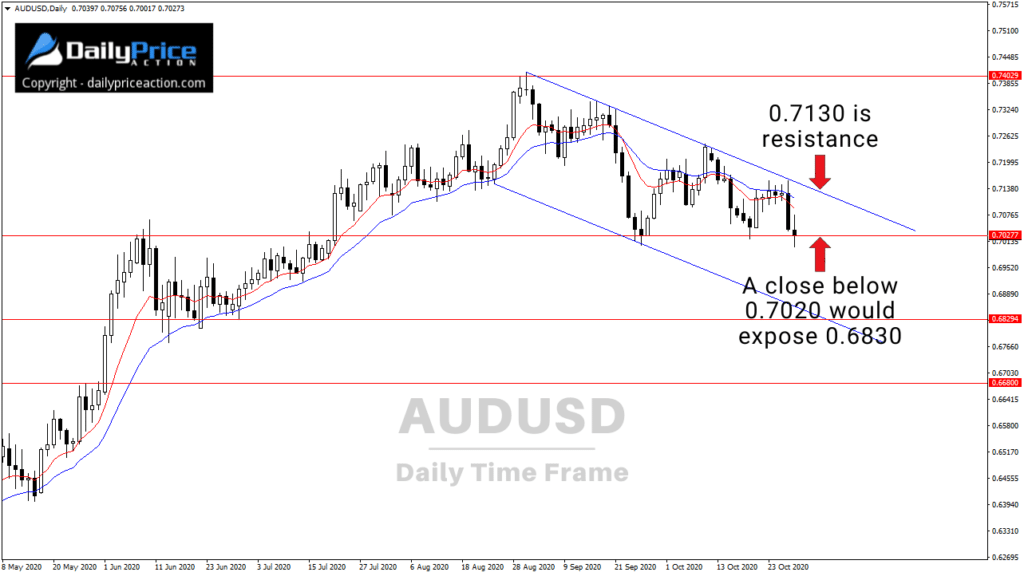

I mentioned the trend line below a couple of times in recent weeks.

Buyers failed to close the pair above it, which means the 0.7030 horizontal support level is under pressure once again.

But buyers may not escape a breakdown this time.

The lower highs since September may be about to take AUDUSD below 0.7020.

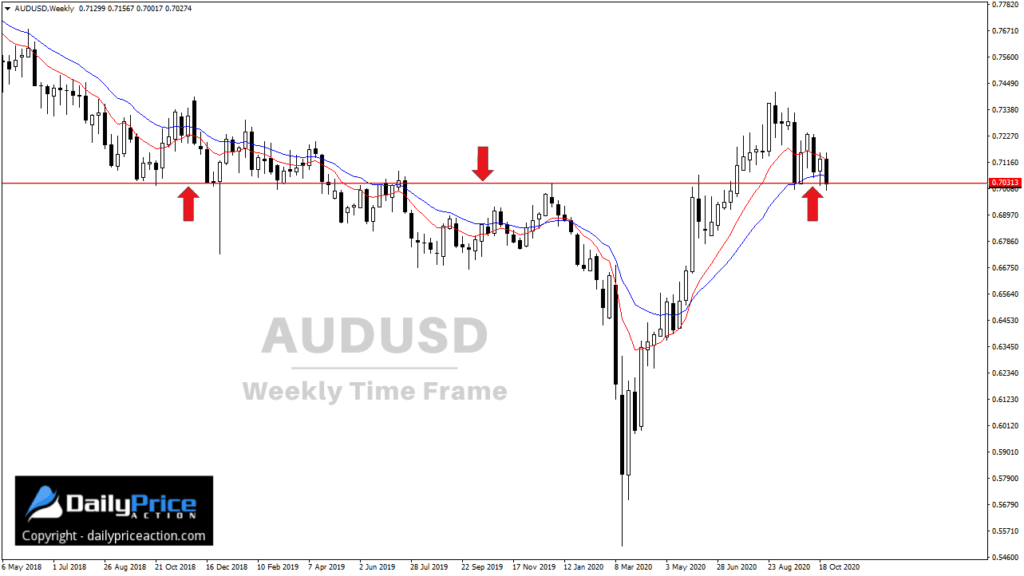

The 0.7020/30 area has been a key factor for years as you can see from the weekly chart below.

One level I’m going to keep an eye on if we do get a breakdown is the bottom of what could be a descending channel.

It “could be” a channel because the bottom level hasn’t been confirmed yet, making it a bit more speculative than usual.

However, I do expect to see buying pressure develop in the 0.6830 region.

If that area doesn’t hold, AUDUSD may head for 0.6680, which is a critical area that dates back to mid-2019.

Just keep in mind that the uptrend since March could play a role here.

So, although I think the Australian dollar could slip lower toward 0.6830 and perhaps 0.6680, any pullback may be short-lived.

In the meantime, I expect weakness to creep in if AUDUSD gives up 0.7020 support on a daily closing basis.

As long as 0.7020 holds, the wedge pattern is in play.

Last but not least, remember that the US elections is next Tuesday, November 3rd, so expect heightened volatility during and after the event.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Watch the AUDUSD Video I Just Released to Members?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in October!

[/thrive_custom_box]