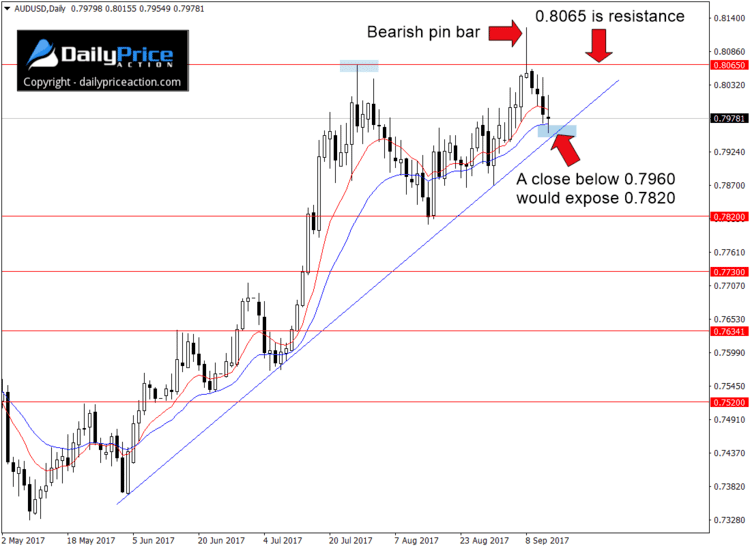

Over the weekend we discussed the bearish pin bar that had formed on the AUDUSD daily chart. Friday’s candlestick pattern left buyers on edge and signaled that a correction this week was likely.

So far, the bearish formation hasn’t disappointed. The pair is down 80 pips from its 0.8054 open on Monday, leaving those who went short just below 0.8065 in the money.

However, the pair is approaching a trend line that could become a factor over the next 24 hours. The ascending level that extends from the June 1st low provided support during the August 31st session which allowed buyers to make a second run at 0.8065.

Similar to the EURUSD chart we discussed a few hours ago, the AUDUSD is having trouble carving higher highs. The pair is also beginning to lean on trend line support in a way that suggests a breakdown is imminent.

For those who are already short based on the Friday pin bar, a daily close (5 pm EST) below this trend line near 0.7960 could offer a chance to add to your position. It could also provide a favorable selling opportunity to those who are still on the sideline.

A daily close below this trend line support would expose the August low at 0.7820. A close below that would pave the way for a move toward 0.7730 and perhaps 0.7635.

Alternatively, a daily close above the 0.8065 handle would negate the bearish outlook and expose last week’s high of 0.8124.

Want to learn how I trade price action? Watch My Free Webinar