[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each 24-hour period closes at 5 pm EST.

Click here to get access to the same style charts I use on this website.

[/thrive_custom_box]

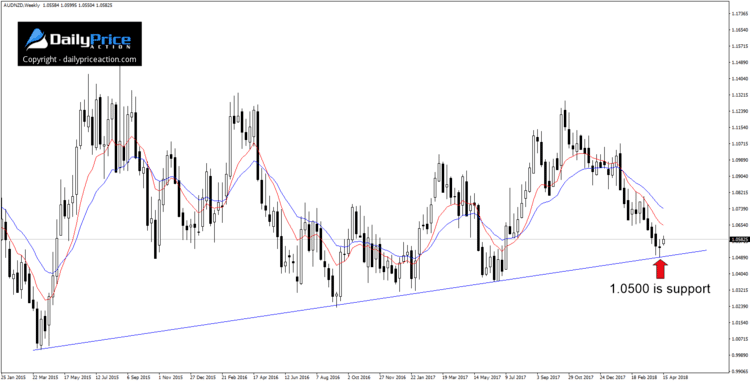

The AUDNZD tested a critical support level last week. The trend line that extends from the 2015 low has received a considerable amount of action over the last three years.

It was also responsible for triggering the 900 pip rally that began in June of last year.

This Australian dollar cross tends to spend much of its time consolidating, but when it does break out, it’s quite aggressive. Judging by the price action since late January, we may be nearing one of those aggressive breakouts.

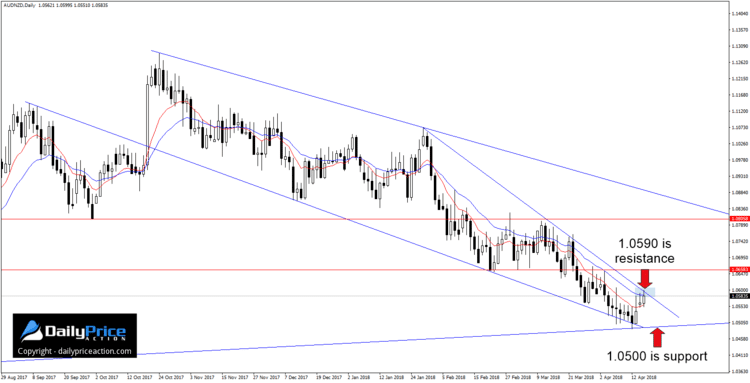

The falling wedge pattern below hints at a push higher over the coming sessions. And the fact that the AUDNZD is fresh off of the 2015 trend line shown above only supports the notion of higher prices.

However, just like any technical structure, it’s imperative to wait for the break. Until buyers secure a daily close (using a New York close chart) above wedge resistance (currently 1.0590), there isn’t anything to do here.

If they do, key resistance on the way up includes 1.0660 followed by 1.0800. The latter will be my target if buyers can get the job done over the coming sessions.

Alternatively, a daily close below 2015 trend line support near 1.0500 would negate the bullish outlook.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to see how we’re trading this? Click Here to Join Justin and Save 70%

[/thrive_custom_box]