The AUDJPY carved out a fresh high last week at 88.17. The last time the pair reached this level was December 31, 2015. And you may recall what happened to the yen crosses in the first few sessions of 2016. In the case of the AUDJPY, it was a 600 pip drop in just four sessions.

Now, I’m in no way insinuating that the same is about to happen. It’s an entirely different time, and we don’t have the catalyst we had back then. But at the very least it’s an interesting observation.

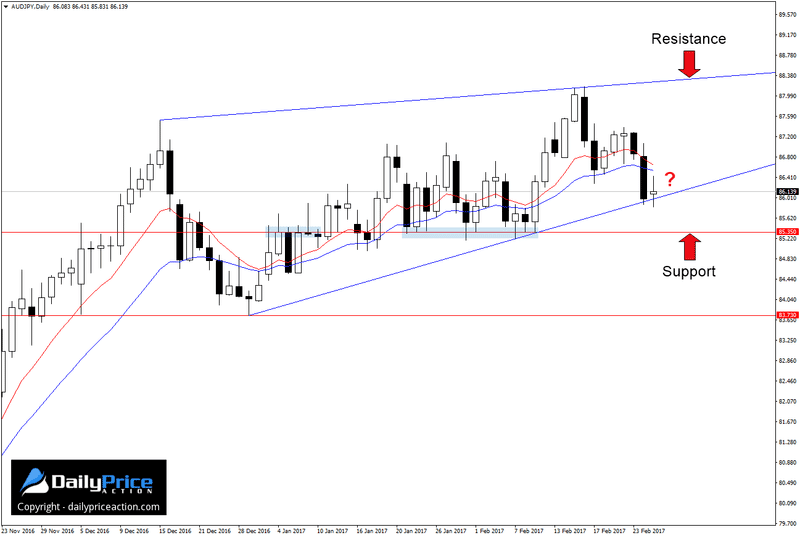

Today I’m watching a rising wedge form on the pair, a technical pattern that typically indicates exhaustion. However, as long as support holds near the 86.00 handle, I’ll remain on the sideline.

A daily close below wedge support would pave the way for a retest of 85.35 followed by 83.73. The latter will be my target but only if a favorable opportunity materializes.

Another interesting observation is how the GBPJPY broke down from a relatively large wedge pattern on Friday. While the two (AUDJPY and GBPJPY) are clearly different, one thing I’ve noticed over the years is when one yen cross reverses course, the rest tend to follow.

Is the GBPJPY signaling a turn lower for the yen crosses as a whole?

For now, the answer is unclear. One thing I do know is that I won’t be fading this AUDJPY rally without a confirmed break of support.

Want to see how we are trading this setup? Click here to get lifetime access.