The Forex pyramid trading strategy you’re about to learn will greatly increase your chances of making consistent returns as a Forex trader. It can literally double or even triple your profits on a single trade.

But as profitable as pyramid trading can be, it can be just as damaging if used improperly. Which is why I wanted to take some time today to walk you through exactly how I use this strategy to double my profit potential.

By the end of this lesson, you will understand the pyramid strategy inside and out. You will be familiar with the dynamics behind the strategy as well as the mechanics that make it so profitable. But most importantly, you will know how to double or even triple your profits on a single trade.

Before we get into the technical side of things, it’s important to first understand the basics of pyramiding.

What is Pyramid Trading?

Pyramid trading is a strategy that involves scaling into a winning position. In other words, strategically buying or selling in order to add to an existing position after the market makes an extended move in the intended direction.

When you’re right – you need to be really right, and when you’re wrong – you need to be a little wrong. This has to be your mentality if you ever wish to become a consistently profitable Forex trader.

Pyramid trading fits perfectly into this mentality because it compounds your winning trades into two or three times the initial profit potential while reducing your overall exposure.

Therein lies the best part about pyramid trading – if done properly, you aren’t exposing yourself to any additional risk. In fact, you are actually mitigating your risk as the trade moves in your direction.

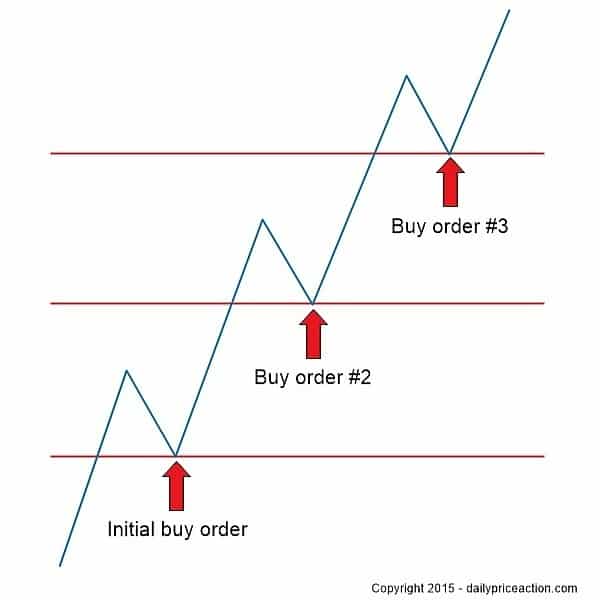

The illustration below shows the basic idea behind pyramiding.

The illustration above shows a market that’s in a clear uptrend, making higher highs and higher lows. This is a nice “stair step” pattern where the market is continually breaking resistance and then retesting that resistance as new support. Market conditions such as this are ideal for scaling into a winning trade.

The initial buy order in the illustration above is triggered when the market retests former resistance as new support. The second and third buy orders are similar to the first, which are both triggered when the market retests a former resistance level as new support.

Keep in mind that the market has to break through each level and then show signs of holding in order to justify adding to the original position. This is why having a strong trend in place is a requirement for effective pyramiding.

Now that you understand the basics of pyramiding, let’s get into the mechanics behind pyramid trading as a strategy.

Forex Pyramid Strategy: How to Double or Even Triple Your Trading Profits

The key to successful pyramiding is to always maintain a proper risk to reward ratio, which says that your risk can never be greater than half the potential reward. So if your profit target is 200 pips, your stop loss must be no greater than 100 pips. This achieves a 1:2 risk to reward ratio, also known as “2R”.

Let’s take a look at another illustration, only this time we’re going to apply position sizing and a proper stop loss strategy.

Using a hypothetical $20,000 account, we would buy 40,000 units (4 mini lots) on a retest of each key level. The profit target for each position is varied, while the stop loss for each new position is 100 pips.

Let’s run through this example starting with the initial buy of 40,000 units. For example purposes, we’re going to assume that the market represented above is in a strong uptrend, so momentum is on our side.

- The market breaks through a level of resistance, and upon retesting the level as new support you notice a bullish pin bar, so you buy 40,000 units (2% risk)

- You decide you’re going to let this trade run because again, you’re trading a market that’s in a strong uptrend

- The market breaks through the second resistance level and again retests it as new support

- You notice the market holding above the new support level so you decide to buy 40,000 additional units and trail your stop loss behind the second position

- Once more, the market breaks through a key level and retests it as new support

- Seeing the continued strength, you decide to buy another 40,000 units and trail your stop once more behind the third position

That’s a lot of buying! At this point you have built up a fairly large position size of 120,000 units at risk. Or is it? The total position size is in fact 120,000 units, but how much of that is actually at risk?

Nothing! In fact by the time you add the third position of 40,000, the worst case scenario is that you make a 6% profit.

What’s the profit potential if the market travels another 200 pips after buying the third block of 40,000 units?

A massive 24% profit.

How’s that possible, you ask?

Let’s crunch some numbers to find out.

The Mechanics Behind Pyramid Trading

Now that you have a good understanding of the dynamics behind pyramiding, let’s dig a little deeper and find out why it’s such a profitable strategy.

The illustration below shows the previous example, only this time we’re including the profit potential along with the risk profile of each entry.

This is where the real magic happens. Notice how the profit potential for each additional position is compounded throughout the trade, while the risk is continually mitigated.

The initial entry would have resulted in a 12% profit, which is considerable on its own. However, by pyramiding, we were able to double the profit on the same trade while reducing our overall exposure.

Let’s take a look at the best and worst-case scenarios for each step of this trade.

First block of 40,000 units

Worst case: 2% loss

Best case: 12% profit

Second block of 40,000 units

Worst case scenario: Break-even (+2% from the first block and -2% from the second)

Best case scenario: 20% profit (+12% from the first block and +8% from the second)

Third and final block of 40,000 units

Worst case scenario: 6% profit (+6% from the first block, +2% from the second and -2% from the third)

Best case scenario: 24% profit (+12% from the first block, +8% from the second and +4% from the third)

As you can see from the figures above, the worst case scenario at any point in the trade is a 2% loss, while the best case scenario is a 24% profit. This makes pyramid trading not only extremely profitable but vastly more favorable compared to most other trading strategies out there.

Conclusion

Pyramid trading can be an extremely advantageous way to compound your profits on a winning trade. However, it isn’t without caveats and it shouldn’t be used excessively. If you find yourself trying to scale into more than one trade per month, there’s a good chance that you aren’t being selective enough about which trades to scale into.

Knowing when to use pyramiding takes a great deal of practice, just as the proper execution takes no small amount of planning. But the potential profit is well worth the time and effort.

Last but not least, don’t get greedy. It’s far too easy to fall into the trap of thinking that the market isn’t going to reverse on you. Remember, markets ebb and flow. Even the strongest trends experience pullbacks to the mean.

Have an exit plan outlined before entering the first trade in a series.

This allows you to define your plan while in a neutral state of mind. If you wait until you’re in a trade before defining an exit plan, there’s a good chance your emotions will get the best of you.

Here are a few things to keep in mind when using the pyramid trading strategy.

- Only use the pyramid strategy in a strong, trending market

- Always define your support and resistance levels before entering the trade (plan your trade and trade your plan)

- Know your exit plan of where you want to book profits before entering the first trade

- Maintain a proper risk to reward ratio at all times

- Trail your stop loss behind each new position in order to mitigate your exposure

- Keep things simple by using the same position size for each block of buying or selling

- Don’t get greedy – stick to your plan no matter what

Above all else, just remember to use pyramiding sparingly. This isn’t a technique you want to use on every trade or even every other trade.

But if you can catch just three or four pyramided trades per year, you’re looking at a profit potential of 60% to 80% from a mere handful of trades. Combine that with the fact that you’re only risking 2% each time, and you have a strategy that is as favorable as it is profitable.

Your Turn

Do you currently scale into winning trades using something similar to the pyramid strategy covered in this lesson? If not, do you think pyramiding is something you will use for future trades?

Leave your answer in the comments section below.