[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each 24-hour period closes at 5 pm EST.

Click here to get access to the same charts I use on this website.

[/thrive_custom_box]

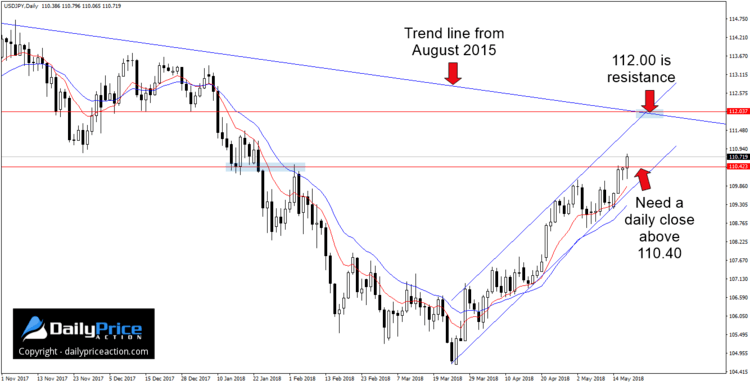

Just when it looked like USDJPY bulls would give up trend line support that extends from the 2018 low, they managed to push prices higher by 150 pips. And instead of a mere trend line, it appears that we now have an ascending channel to work with.

At the moment, the USDJPY is trading at 110.72. That’s well above the 110.40 handle. This is an area that served as a pivot between January 15 and February 2 of this year.

But with six hours left in today’s session, anything can happen. Remember, without a daily close at 5 pm EST (New York close chart), we don’t have enough information to make a decision one way or the other.

However, if the USDJPY does manage a daily close above 110.40, I will begin watching for a retest of the area as new support. Given the recent strength and position of the 110.40 level in relation to today’s range, I probably won’t wait for bullish price action to pull the trigger.

The next resistance level comes in just below 112.00, which is the intersection of ascending channel resistance and the trend line from August 2015.

There is also a horizontal level at 112.00 that served as support throughout December of last year and again on the 2nd of January. That means any retest of the level as new resistance will likely attract selling pressure.

Alternatively, if buyers fail to close today’s session (or any session hereafter) above 110.40, we could see the USDJPY slip toward channel support near 110.00.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Learn How to Swing Trade?

Click Here to Get The Ultimate Forex Swing Trading Cheat Sheet

[/thrive_custom_box]