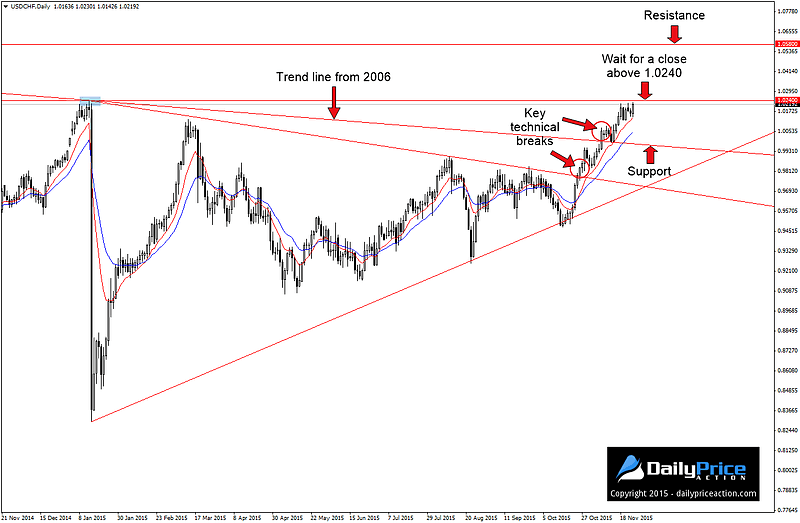

Almost one month ago exactly, I mentioned the key technical break that had occurred on USDCHF. The resistance level in focus was part of a nine-month wedge pattern that began forming as a result of the January 15th intervention by the SNB.

The event led to a massive 1,900 pip decline for the currency pair in a single day. Naturally, such a drastic move called for consolidation, which is exactly what the pair did for the next nine months.

Since the break on October 26th, the pair has managed to climb 400 pips and is now retesting the former 2015 high at 1.0240. This is the first retest of the level since January 14th, the day before the SNB sent the pair into a tailspin.

So where to next?

First off, I’m not interested in attempting a short from current levels. While 1.0240 is acting as resistance, any selling here is technically against the grain. I also believe that the October 26th break was much more significant than many traders may realize and is potentially worth quite a bit more than 400 pips in the long run.

However, we are also just below key resistance, so we don’t want to buy at current levels either. This leaves us waiting for a daily close above the 1.0240 handle for a second breakout opportunity.

This would offer traders a chance to take an initial long position while allowing those with current exposure to add to their positions accordingly.

My bullish bias will remain intact as long as the pair remains above former trend line resistance that extends off of the 2006 high on a closing basis. Key resistance above 1.0240 comes in at 1.0580 and 1.0900.