USDCAD has offered up some great buying opportunities this year that have been more obvious than not. It started with the bullish pin bar on January 15th, followed by the bullish inside bar on March 9th.

The latest opportunity was the break from the descending channel that began on March 18th. The ensuing rally is still underway and has so far produced a gain of 340 pips.

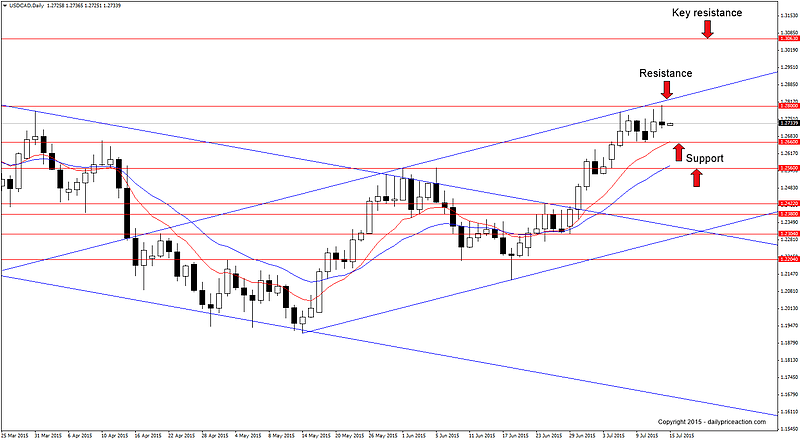

The pair now finds itself trapped between the 1.2800 resistance level combined with channel resistance and immediate support at 1.2660.

This is important to note as the Bank of Canada rate statement is on tap tomorrow at 10am EST. Even if the rate stays the same, any hawkish or dovish rhetoric from the governor could result in drastic price action for USDCAD.

Due to the bullish momentum of late, I am only interested in a break of resistance which would likely trigger a move back to the 2009 high at 1.3063. On the other hand, a daily close below 1.2660 would open up the possibility for a retest of the 1.2560 area. Either way I’m only interested in buying dips as long as the pair remains above 1.2420.

Summary: Wait for a daily close above channel resistance and then watch for a long opportunity on a retest of the level as new support. Key resistance and target comes in at 1.3063. Alternatively, a break below 1.2660 would trigger a retest of the June highs at 1.2560 as new support.