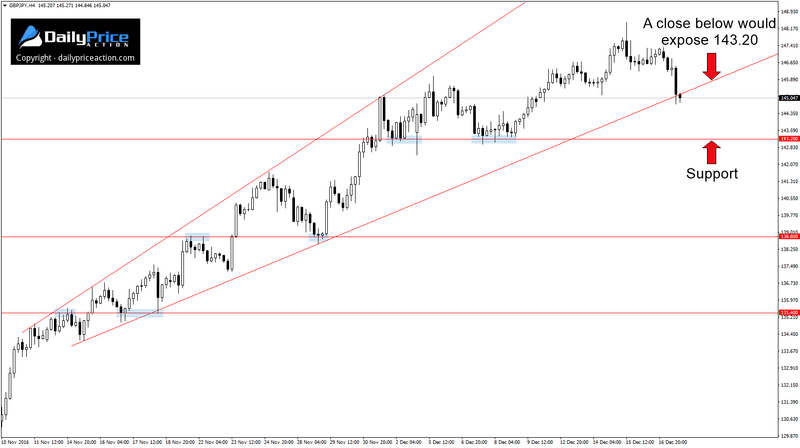

On December 1st I pointed out a broadening wedge that was forming on the GBPJPY 4-hour chart. At the time, the pair was trading near 144.00 and had just tested wedge resistance for the third time.

These formations can serve as an early warning sign that either buyers or sellers are tiring. In the case of the ascending broadening wedge on the GBPJPY, it signals that buyers are becoming exhausted.

Fast forward to today, and we can see that the pair is still trading higher than it was nearly three weeks ago.

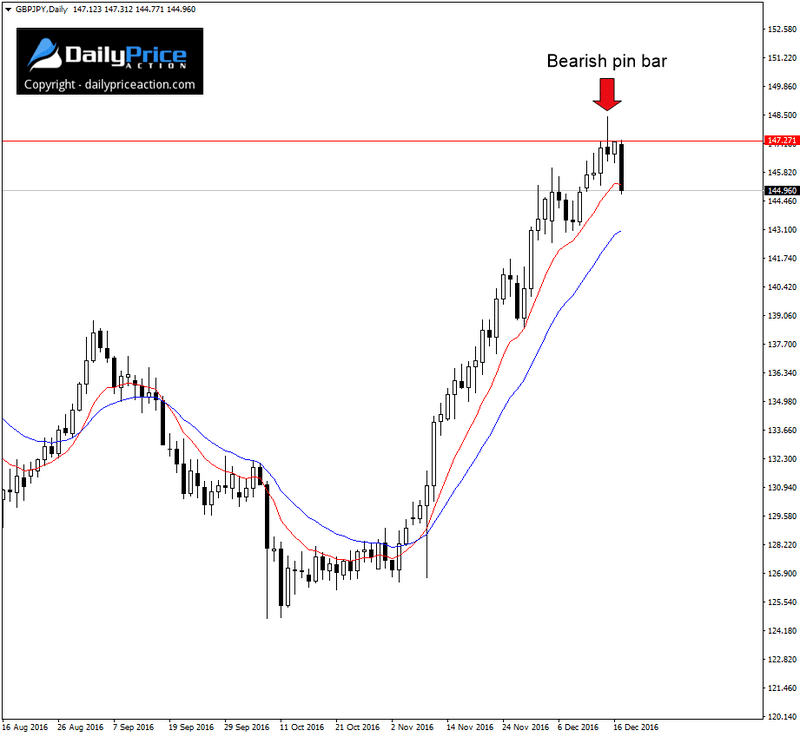

However, there are two developments that I want to call your attention to. The first is the bearish pin bar that formed last Thursday.

Remember the 147.00 handle that I mentioned the last time around? If not, here’s an excerpt from the December 1st commentary:

Furthermore, the pair is approaching a confluence of resistance at the 147.00 handle. This area is the intersection of wedge resistance, but more importantly, it was a key pivot in 2013 as well as the 61.8% Fibonacci retracement when measuring from the 2011 low to the 2015 high.

From here traders can watch for a close below wedge support as a sign of extended weakness. Such a break would expose the 138.80 handle followed by 135.40. Alternatively, bearish price action on a retest of the 147.00 area could make for an attractive selling opportunity.

Now, whether or not Thursday’s price action qualified as an entry signal for you depends on many things including your trading style. It was a decent setup, but with wedge support just below the 147.00 area, it did pose some challenges.

But the second development is the one I’m most interested in going forward.

As I type this, the pair is testing 4-hour broadening wedge support for the third time since its inception on November 15th. A close below this level could trigger a reversal or at least a correction over the coming sessions.

There’s no denying that the pair is in need of a healthy pullback given the 2,180 pip rally since the November 9th U.S. elections.

As mentioned in the previous commentary, a close below wedge support would expose the 138.80 handle. A break below that would open the door for a move toward the next support at 135.40.

Recent lows from the beginning of December at 143.20 could also challenge sellers, although the level isn’t likely to have a lasting impression.

Last but not least, keep in mind that the BOJ rate decision and policy statement are just around the corner. Although there’s no set time, they should occur sometime during the upcoming Tokyo session, so expect trading conditions to worsen a bit during and after the events.

Want to see how we are trading this setup? Click here to get lifetime access.