With weakness comes opportunity. This is certainly true for the Forex trader where the biggest gains often come from relative weakness rather than strength.

The recent state of the British pound is a perfect example. The false break above 1.4670 last week against the USD was a red flag for buyers, indicating that the market isn’t quite ready to shake Brexit fears.

Of course, this frailty has spread to other pairs such as GBPCAD, a pairing that until recently was in rally mode.

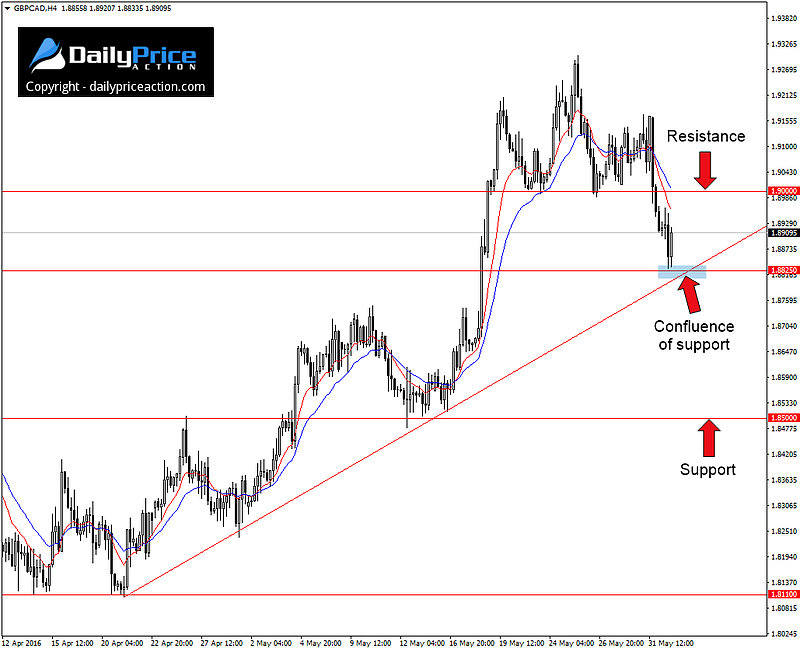

However, yesterday’s break below 1.90 left the pound cross vulnerable to further losses and exposed a confluence of support at 1.8825, an area that just came under fire.

The 1.8825 handle played a vital role as both support and resistance throughout March and is also the 38.2 Fibonacci retracement when measuring from the April low to the current 2016 high. In addition, this area intersects with a well-established trend line that extends from the April 21st low.

All of the above leads me to believe that a close below 1.8825 would likely trigger further weakness toward the next support level at 1.8500.

Why not buy from this area instead?

Although not yet confirmed, there is a chance that the bigger picture on the weekly chart has carved out a massive head and shoulders pattern. Kudos to one of my members for pointing this out.

Within the structure above, you’ll also notice the double top that we took advantage of in our short setup from February, a trade that yielded 880 pips.

That said, the immediate opportunity here, in my opinion, would materialize with a close below the confluence of support at 1.8825. Such a move would expose 1.8500 and possibly the current 2016 lows at 1.8110.

Want to see how we are trading this setup? Click here to get lifetime access.