EURUSD bulls have cleared yet another key level with yesterday’s close.

That makes five straight days of gains. It’s the longest streak since the euro bottomed at 1.1300 on August 15.

By the way, that rally eventually topped out on September 24th after a gain of just over 500 pips.

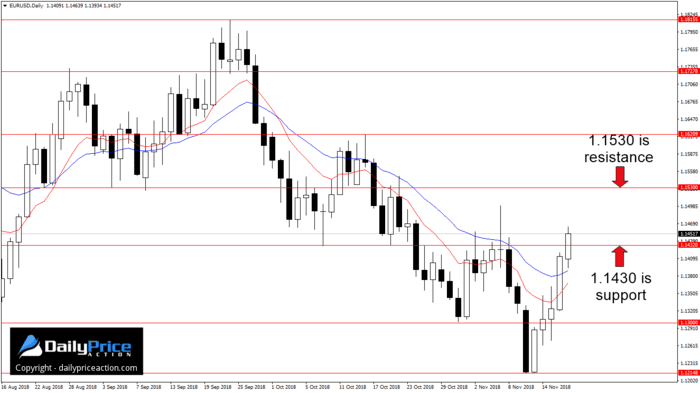

With Monday’s close above 1.1430, buyers have their eyes set on 1.1530.

However, I suspect we may see a retest of 1.1430 as new support before buyers can muster enough strength for another push higher.

As long as 1.1430 holds as new support on a daily closing basis, upside targets are exposed.

One such target is 1.1730. Yes, I know that may seem like a stretch. But I have my reasons for targeting that area, two of which I shared with members last week.

I still have my long position from 1.1335 and will be interested in adding to it following yesterday’s close.

Make no mistake though; this is a counter-trend idea. It has been since I cautioned readers about shorting EURUSD last Thursday.

But as I told members this morning, I’m not shy about using price action to identify potential tops and bottoms, even if it’s against the longer term trend.

So far so good. We’ll see if buyers can keep this up.

A successful retest of 1.1430 (new) support could trigger a move to the next key resistance at 1.1530.

Beyond 1.1530 we have 1.1620 followed by 1.1730.

Don’t discount a move to the latter though. EURUSD managed a 500+ pip rally earlier this year, so bulls have proven they can do it.

And if they do it again from last week’s low at 1.1215, it would put the euro right at the 1.1730 mark.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

IMPORTANT: I use New York close charts so that each day closes at 5 pm EST.

[/thrive_custom_box]