[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts. Click Here to Use My Preferred Broker

[/thrive_custom_box]

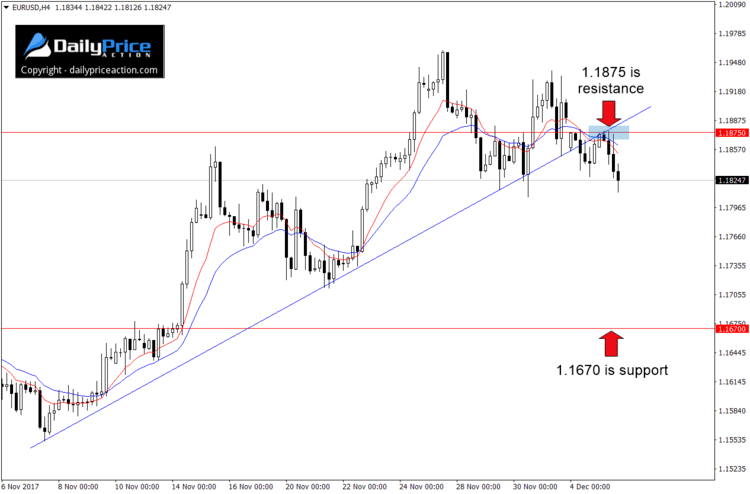

Over the past 24 hours, the EURUSD has closed below trend line support and retested it as new resistance. We looked at this level a couple of times last week including during Thursday’s session.

Just hours into the start of the new week, the single currency surrendered the support level on a 4-hour closing basis. I mentioned the breakdown in the member’s area nearly 24 hours ago.

The EURUSD then went on to test the 1.1875 area as new resistance (see chart below). It seems the pair is finally behaving after several days of indecisive price action.

As long as sellers maintain sub 1.1875 prices on a daily closing basis, I favor selling the Euro against the greenback.

We can see how EURUSD bulls came out in support of the 1.1820 area earlier today. The region has been somewhat of a pivot for the pair since early August.

Keep in mind that the USDCHF descending channel I posted earlier in today’s session will be a key factor here. You can see a similar pattern on the Dollar Index (DXY).

If the USD can breach channel resistance on a daily closing basis at 5 pm EST, it will help validate a lower EURUSD. Those looking for further confirmation can wait for the U.S. dollar to clear resistance before pursuing a short here.

I don’t often use other markets in this manner, but it seems to make sense in this case.

For the single currency, the next key support comes in at 1.1670. Note that we could also see an influx of buying pressure at the November 21 low of 1.1712.

Below the 1.1670 handle, we have our original target from late October at 1.1490. The area served as a pivot in July and also capped advances in February, May, and October of 2015.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to see how we’re trading this? Click Here to Join Justin and Save 70%

[/thrive_custom_box]