The currency market seems determined to keep a lid on the range-bound price action of late. However, just now we’re starting to see some of those ranges begin to breakdown, namely on the AUDUSD and NZDUSD.

But the same can’t be said for the yen crosses. All are trading within relatively tight ranges that have persisted for several weeks now, including the EURJPY.

That isn’t necessarily a bad thing, though. These market conditions call for short-term swing trades that last a few days or perhaps a week at most. And until the yen crosses can prove otherwise, that’s how I’ll continue to approach any setups that materialize.

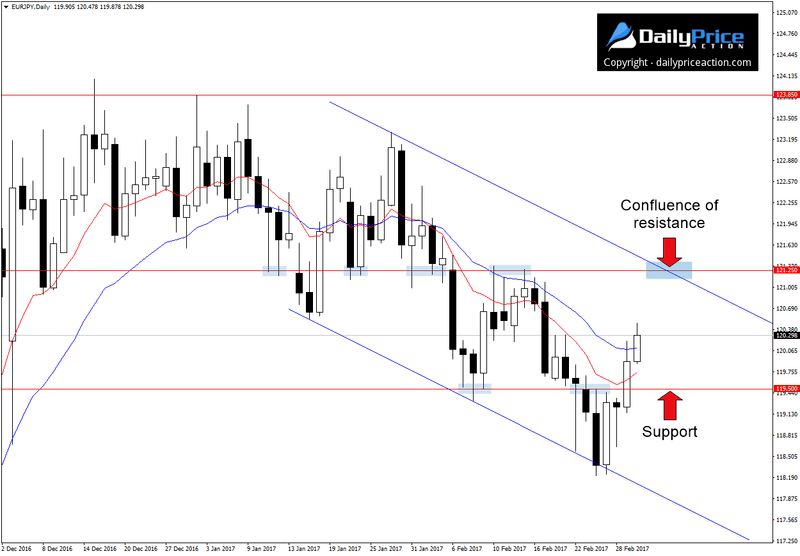

Despite falling below the 119.50 handle last Thursday, the EURJPY has returned with a vengeance this week. And with yesterday’s close, we find ourselves once again focused on 119.50, only this time as support.

In case you’re wondering why last week’s close didn’t prompt a selling opportunity this week, the chart below offers an explanation. The trend line that extends from the January 17th low is what triggered Monday’s bounce.

If we use this trend line to draw a parallel level from the January 27th high, we get what appears to be the beginnings of a descending channel. Although the upper boundary has yet to be confirmed, it does intersect with a key horizontal area at 121.25. This region has served as a key pivot so far in 2017.

A rotation back to 119.50 could present a buying opportunity. However, I’m going to play this one rather cautiously given some of the mixed signals we’ve seen from the yen crosses lately.

With that said, the bigger play here, in my opinion, will materialize once the EURJPY breaks free from this range. A close above the confluence of resistance at 121.25 would expose the December 2016 highs near 123.85.

Alternatively, a daily close back below 119.50 would pave the way for the third retest of channel support. But for now, I’ll remain on the sideline and wait for the market to make the first move.

Want to see how we are trading this setup? Click here to get lifetime access.