[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Important: I use New York close charts so that each 24-hour period closes at 5 pm EST.

Click here to get access to the same charts I use.

[/thrive_custom_box]

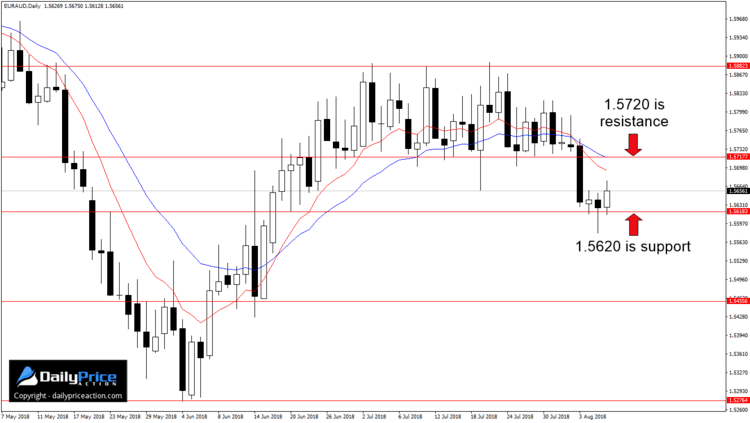

The EURAUD has been tentative so far this week, especially when compared to Friday’s selloff. That isn’t surprising though, at least not for those who have been following along.

Despite having broken free from a five-week range on Friday, sellers have run into another floor at 1.5620. I mentioned this level a couple of times last week including in Sunday’s forecast.

Monday’s session was the first to catch a bid here, but Tuesday’s long lower wick illustrates the demand in this region.

Whether or not this will trigger a retest of former range support at 1.5720 as new resistance is anyone’s guess. What I do know is that attempting shorts while the EURAUD is above 1.5620 on a daily closing basis (New York 5 pm EST) is probably a bad idea.

The way I see it, there are two options for getting short here…

The first would involve a rotation higher and retest of former range support at 1.5720. Whether you wait for bearish price action such as a pin bar or not would be up to you.

Option number two would materialize in the event buyers are unable to force a retest of 1.5720. In that case, a daily close below the current support level at 1.5620 would open the door to the next key support at 1.5450/60.

Of course, if you don’t share my bearish outlook, you could look to enter long at support and exit at resistance. It all depends on your bias here, as well as your trading style.

As for me, I’ll wait for one of the two short ideas above to materialize. Keep in mind too that the EURAUD’s pound counterpart (GBPAUD) confirmed what I suspect is a 1,200 pip head and shoulders pattern earlier this week.

Given that the two move in tandem more often than not, that confirmation on the GBPAUD could be an early warning sign for the Euro cross. As always, time will tell, but I certainly won’t be buying this one anytime soon.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to Learn Step-By-Step How I Swing Trade the Forex Market?

Click Here to Register for the Free Webinar!

[/thrive_custom_box]