Seeing that I recently wrote about the potential for EURCAD and GBPCAD gains, it would only seem fitting that CADJPY may be on the brink of a larger correction.

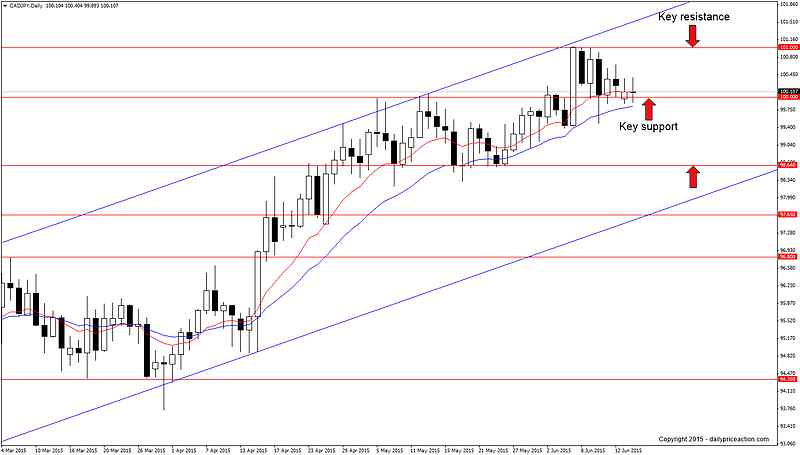

The pair has experienced a slow but steady rally from the January low of 91.75. Since that time the pair has carved out a well-defined ascending channel that has guided the price action over the past five months.

Whether we see a true correction from current levels or more sideways price action is still unclear. What is clear, however, are the key levels that have influenced the market for several months now.

The big level to keep an eye on at the moment is the psychological level of 100. Since breaking through this barrier on June 5th the pair has found support here several times. That said, the market does appear to be having some trouble finding additional buyers to push prices higher from this key area.

Although we may see a favorable setup form on CADJPY, I do think that any Canadian dollar weakness may be better represented through pairs such as EURCAD or GBPCAD, both of which have been mentioned previously as having upside potential.

Summary: Wait for a daily close below 100 and then watch for bearish price action on a retest as new resistance. Key support comes in at 98.64 and channel support from the January 30th low.