Almost one month ago I mentioned two areas on AUDJPY that were likely to test bullish conviction. The first area of resistance broke down the very next day and triggered what would eventually become a 330-pip rally.

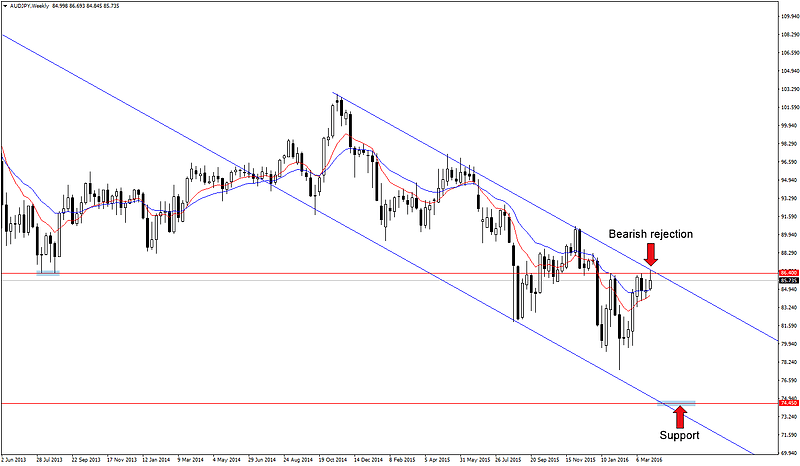

The second area, on the other hand, was much stronger than the first. The 86.40 level is a confluence of resistance that includes seventeen-month channel resistance, multiple 2016 swing highs as well as the 2013 low.

If that weren’t enough, it’s also the 38.2 Fibonacci retracement level from the 2008 low to the 2013 high.

The strength of this level was on display throughout the week with AUDJPY failing to close above the key handle despite several attempts. Fast forward to the end of the week and we have a bearish rejection candle as we transition into a new month.

I have always treated bullish and bearish rejection candles as suggestions rather than full on trade setups, and this one is no different. As such, we could see some sideways price action to start next week or even a move higher from here, but as long as channel resistance holds, I will continue to favor the downside.

That makes the AUDJPY price action you see below more of a watch list item than an actionable trade idea. But the previously mentioned confluence in the 86.40 region should be enough to keep this one at the top of your list as we head into next week.

That makes the AUDJPY price action you see below more of a watch list item than an actionable trade idea. But the previously mentioned confluence in the 86.40 region should be enough to keep this one at the top of your list as we head into next week.

As a side note, CADJPY is moving in lockstep and has formed a weekly bearish pin bar at the resistance area I mentioned on Wednesday. See the chart to the right.