I’m going to do things a little different this time given the volatility that could result from today’s outcome of the French elections. I’m still providing the immediate support and resistance levels for the pairs below, but I’ll also discuss each from a broader perspective.

I will then provide updates throughout the week once markets have had a chance to digest this weekend’s event.

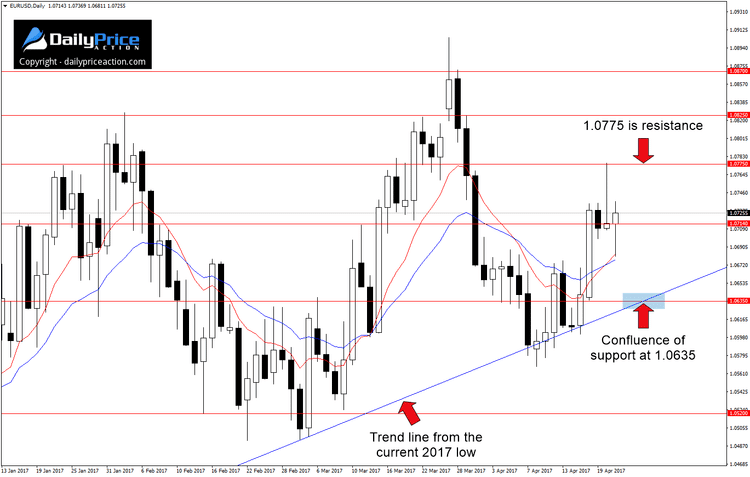

The EURUSD struggled last Thursday, failing to close the session above the 1.0712 area. I mentioned this possibility when the pair was trading closer to the 1.0775 handle.

Friday’s close put the pair back above 1.0712, but I’m taking it with a grain of salt as Monday’s open could be vastly different from last week’s closing price.

From a broader perspective, my outlook here remains bearish. The single currency continues to chop sideways following the 3,400 pip drop that began in May of 2014.

A close above 1.0900 is needed for buyers to negate the short to intermediate bearish outlook. Alternatively, a close below the confluence of support at 1.0635 could trigger further losses toward multi-year lows at 1.0370.

Depending on the outcome of today’s French elections, the EURUSD could realize either one of those scenarios this week. I’ll stand aside for now and give the market at least 24 hours to digest the outcome. That goes for every currency pair, not just the EURUSD.

Want to see how we are trading these setups? Click here to get lifetime access.

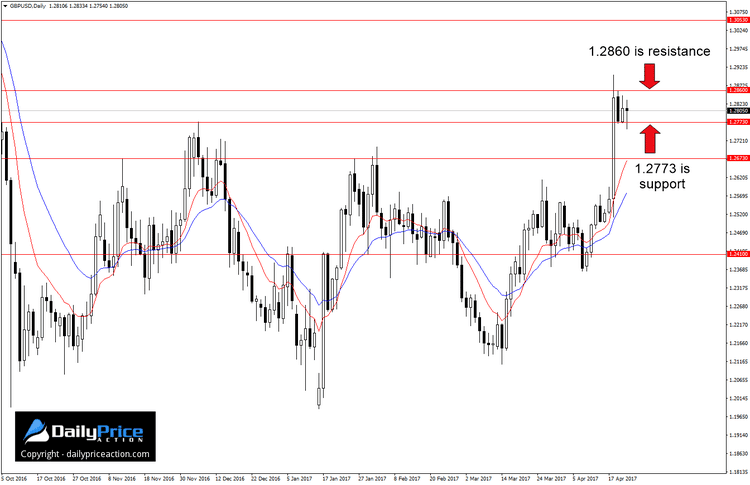

The GBPUSD went parabolic on Tuesday, gaining 280 pips from Monday’s close. Not surprisingly, buyers took a breather for the rest of the week but managed to hold prices above 1.2773 on a daily closing basis.

Last week ended with the pair trading in a tight range between 1.2773 and 1.2860. However, just like many other currency pairs, this week’s open and early trade will depend on how markets interpret the outcome of the French elections.

All in all, the GBPUSD looks like a pair ready to turn higher after nearly a year of being beaten down following the June 24th Brexit.

If we see the pair climb above 1.2860, there isn’t much standing in the way of a push toward the 1.3050 area. On the flip side, it’ll likely take a close below 1.2670 to negate the bullish scenario and re-expose the 1.2410 handle.

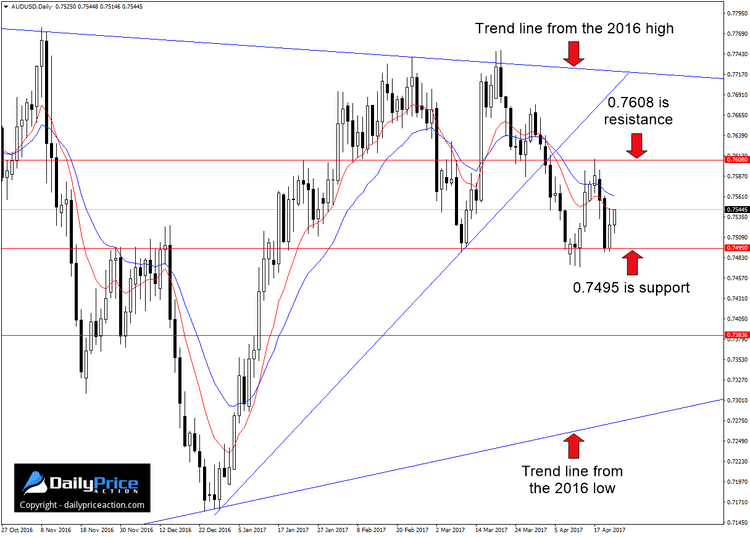

I’ve said it before, and I’ll say it again, the AUDUSD has some of the best-looking technicals in the Forex market at the moment. I mentioned the 0.7608 resistance level last weekend as one to watch for selling opportunities.

Sure enough, last week’s high was 0.7609. I took a short from the area and booked profits on Thursday near 0.7520. My target was actually lower at 0.7380 but the 0.7495 support held for the third time since March 9th.

I’ll stand aside, for now, to see how the pair opens the new week. While I’m still interested in shorting the pair for an eventual break of the 0.7500 area, I need to wait for a favorable opportunity to present itself.

From a broader perspective, the AUDUSD continues to trade within a 430 pip wedge pattern. You can view the full pattern in this post. I will continue to trade this range using key levels to time entries and exits until one side prevails.

Want to see how we are trading these setups? Click here to get lifetime access.

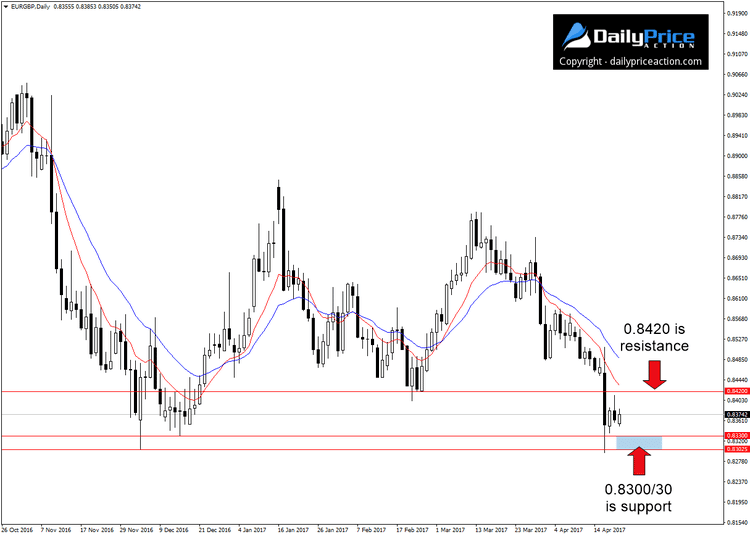

The EURGBP could be setting up for a substantial decline over the coming weeks and months. The head and shoulders pattern that’s been developing since the middle of last year points to a 0.7520 measured objective.

However, the pattern has yet to be confirmed as the neckline at 0.8300/30 has yet to break down. Until that happens, the bearish outlook is just speculation.

We’ll see if today’s outcome of the French elections has a bearing on this potential reversal pattern. Immediate resistance comes in at 0.8420.

See this post for a view of the potential head and shoulders as well as additional support levels on the way down.

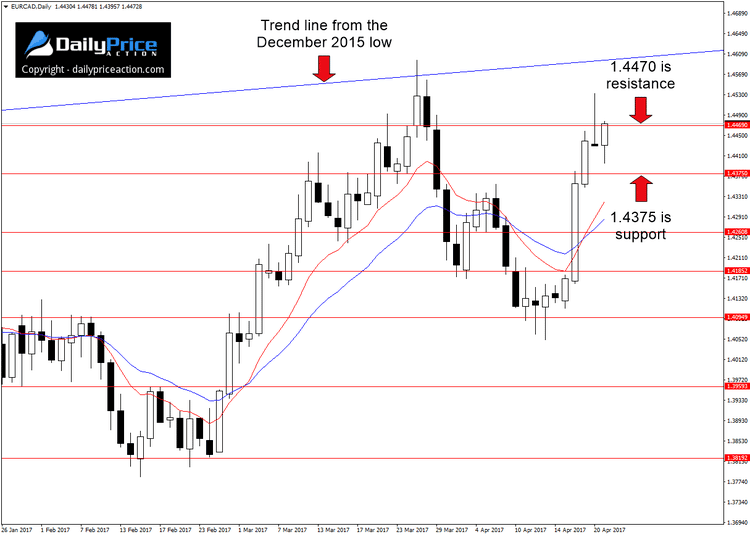

The EURCAD has produced some nice swings for us in recent weeks. First came the 500 pip drop that commenced with a retest of former trend line support from the December 2015 low.

I ended up shorting the pair a few weeks ago based on the ascending channel that had developed on the 1-hour chart. The bullish engulfing day on April 13th prompted me to book profits and also triggered last week’s 340 pip rally.

Despite the recent aggressive move higher, buyers face substantial headwinds so long as the pair trades below 1.4600. It’s unknown at this point whether Thursday’s bearish pin bar is a hint of things to come.

I’ll stand aside for now, but my somewhat bearish outlook will remain intact so long as 1.4600 holds on a daily closing basis. A daily close below the 1.4100 area could exacerbate the decline that began on March 28th.

Want to see how we are trading these setups? Click here to get lifetime access.