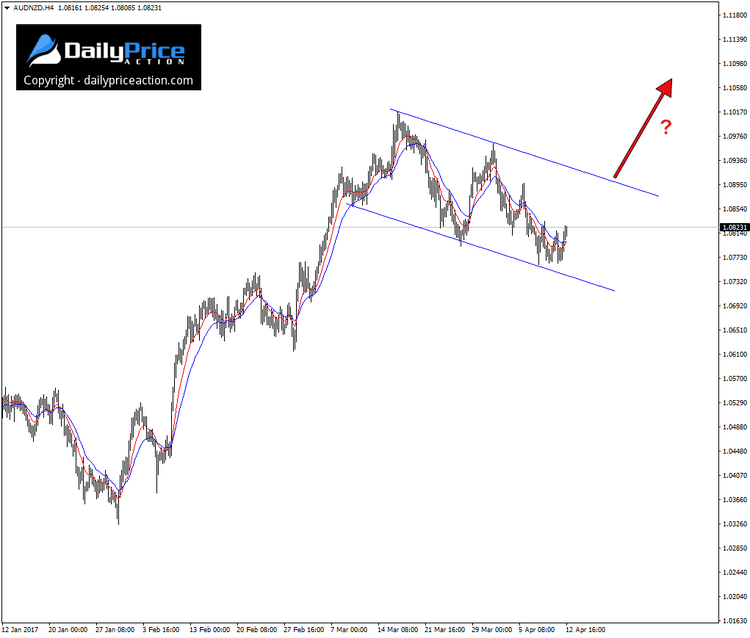

Over the weekend I mentioned the 1.0765 handle on the AUDNZD. Before the March 3rd close above the area, it had served as resistance on several occasions since May of last year.

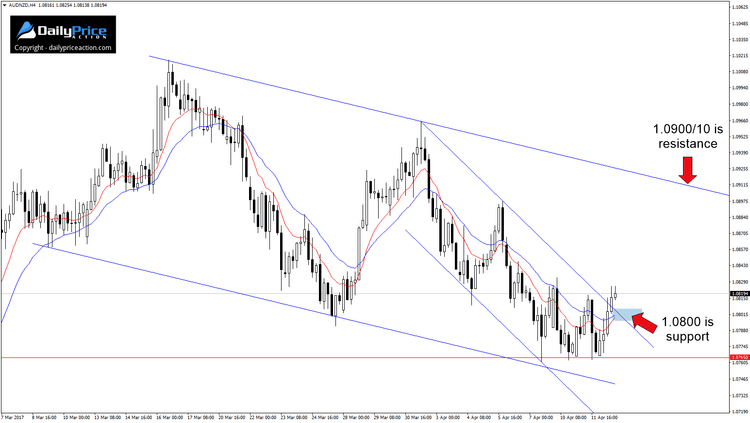

Although buyers haven’t shown much urgency, they have managed to hold price above the 1.0765 area this week. Furthermore, if we drill down to the 4-hour chart, we have what appears to be a channel within a channel.

The price action over the last four weeks has carved out the larger of the two patterns. This formation has the look of a bull flag following the 690 pip run up from the current 2017 low of 1.0325.

Within this descending channel, we have a similar yet steeper pattern. Today’s intraday break above resistance at 1.0808 signals that buyers may be ready to have another go at the larger channel resistance near 1.0900/10.

From here, there are two ways to play the recent price action. The first is to watch for a buying opportunity on a rotation back to former resistance near 1.0800. A firm bid in this area would likely take the pair back to the 1.0900 region.

The second option is to wait for a break of the larger channel before considering an entry. Although you’ll miss a portion of the move, the four-week structure is the more obvious play here in my opinion.

I’m going to stand aside for now given the upcoming Australia employment figures at 9:30 pm EST. If we get a proper buy signal following the event, I may consider an entry. Otherwise, I’ll wait for a close above resistance near 1.0900/10.

Want to see how we are trading this setup? Click here to get lifetime access.