The GBPUSD continues to defy the odds. While other currencies such as the Euro and Australian dollar have weakened against the greenback of late, the British pound has remained firm.

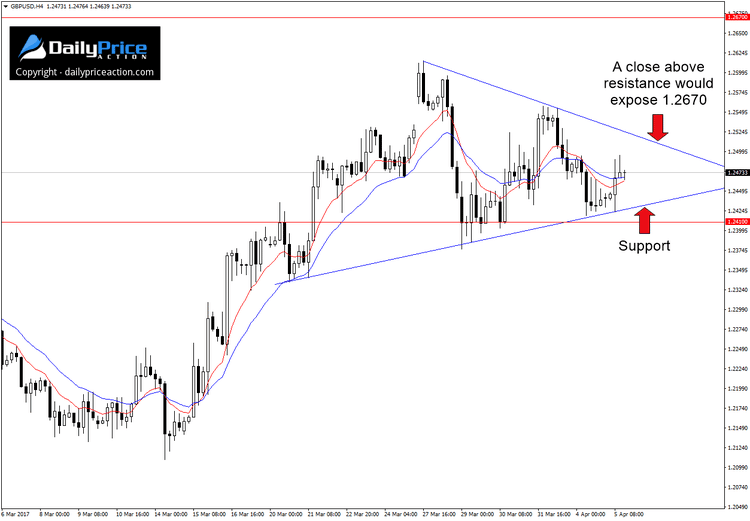

I reviewed the pair over the weekend and pointed out the March 29th retest of new support at 1.2410. This was the intersection of former channel resistance and a horizontal level that has acted as a pivot since late November of last year.

But the telltale sign here is the fact that the pound has held firm despite broader U.S. dollar strength. Disparities such as this can often signal the start of a larger theme.

From a technical standpoint, the 4-hour wedge in the chart below could also offer a hint as to the pair’s likely path forward. Since coming off the March low at 1.2109, the GBPUSD has consolidated into what appears to be a wedge pattern.

However, the structure is still in process, so we won’t likely have a definitive answer for another few sessions.

One event that should spark volatility here and elsewhere is this Friday’s non-farm payroll. By that time the pair will have broken support or resistance or be very close to doing so.

A 4-hour close above wedge resistance followed by bullish price action on a retest would expose the 1.2670 area. Note there is also some resistance on the daily chart near 1.2570.

Alternatively, a close below wedge support and more importantly the 1.2410 handle would negate the bullish outlook for the pair.

Want to see how we are trading this setup? Click here to get lifetime access.