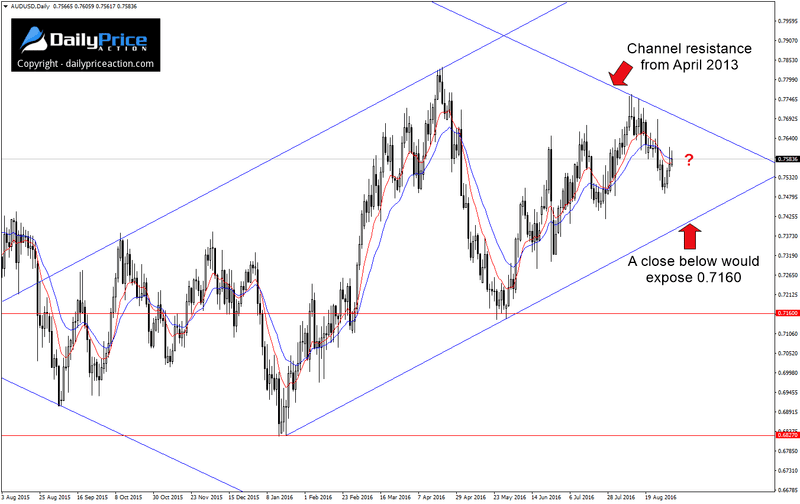

Since the start of 2016 AUDUSD has traded within an ascending channel that extends from the 0.6827 handle. It’s one of the more prominent technicals patterns on my watch list and is something I mentioned several times back in July.

As impressive as the eight-month channel is, there is an even larger descending channel in place that dates back to April of 2013.

The two weekly bearish pin bars that formed last month were byproducts of channel resistance at 0.7750. With the pair now off of those weekly highs by 170 pips and an RBA rate statement just around the corner, AUDUSD is at a crossroads.

To be clear, I have no intention of trading the Aussie ahead of the 12:30 am EST decision by the Reserve Bank of Australia. The uncertainty combined with the heightened volatility that follows a decision such as this create a trading environment that is less than favorable.

And given the long-term resistance area just above current prices at 0.7750, I’m also not interested in a long position. I am, however, interested in selling the pair but only if we get a daily close below ascending channel support, which is still about 150 pips away.

Such a close would expose the May low at 0.7160 with a break there opening the door for a retest of the current 2016 low at 0.6827.

In summary, I’ll be on the sidelines until this ascending channel gives way, at which time I’ll begin watching for selling opportunities for a potential move lower.

Want to see how we are trading this setup? Click here to get lifetime access.