The US Dollar Index is making big moves today ahead of Wednesday’s anticipated Federal Open Market Committee (FOMC).

What specifically should you watch for, and how might that affect the major currency pairs?

I’ll have all the answers in today’s episode of The Daily Edge!

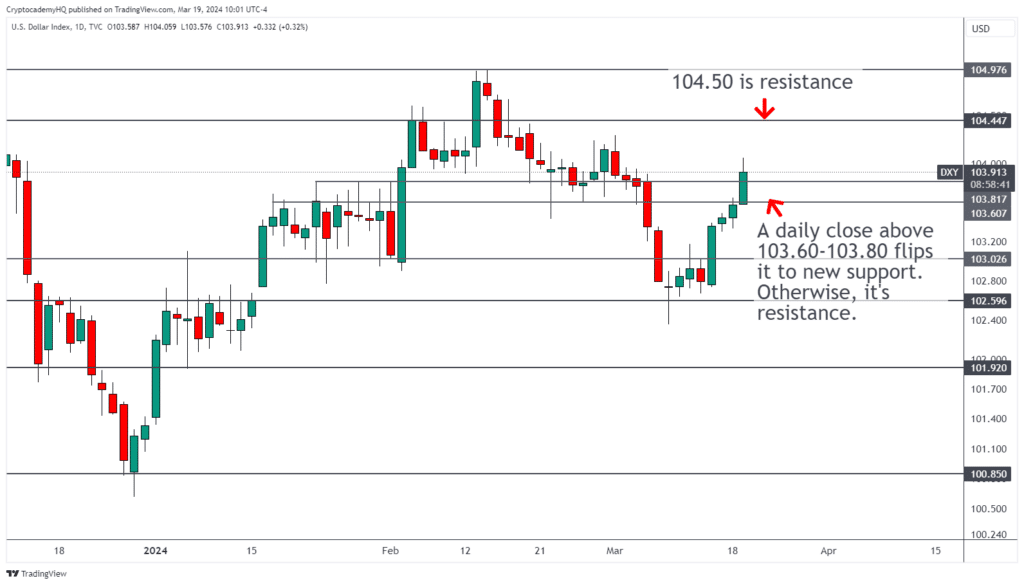

[embedyt] https://www.youtube.com/watch?v=mYVdC9b6cuA[/embedyt]The DXY is attempting to reclaim a critical area just 24 hours ahead of this week’s FOMC.

We’ve discussed the significance of 103.60-103.80 ever since the dollar index reclaimed 103.00.

That 103.00 reclaim last Thursday is what turned me cautiously bullish on the USD.

I’ve since gotten short GBPUSD near 1.2800, and more recently the S&P 500 at 5,178.

Both entries were shared live in the Daily Price Action VIP group.

As for the DXY and today’s rally, everything hinges on where today’s session closes.

While intraday price action can sometimes be useful, a significant area like 103.60-103.80 requires a daily close above to flip the area to new support.

That would expose 104.50 and 105.00 post-FOMC.

Alternatively, a daily close below 103.80, and especially 103.60, would keep the area intact as resistance going into Wednesday’s FOMC.

Want me to help you become a better trader? Join our VIP group for daily analysis videos, exclusive charts and setups, and see my trades in real-time! Plus, get the new video course that launches this month!