XAUUSD (gold) suffered a significant loss on Tuesday.

At more than five percent, it was the largest single-day drop in the last few years.

Even the March selloff didn’t register a loss that significant, at least not at the daily close.

However, I don’t see any scenario where XAUUSD becomes a sell, at least not in the long run.

The uptrend is intact as is the cyclical bull market that I’ve been discussing for weeks.

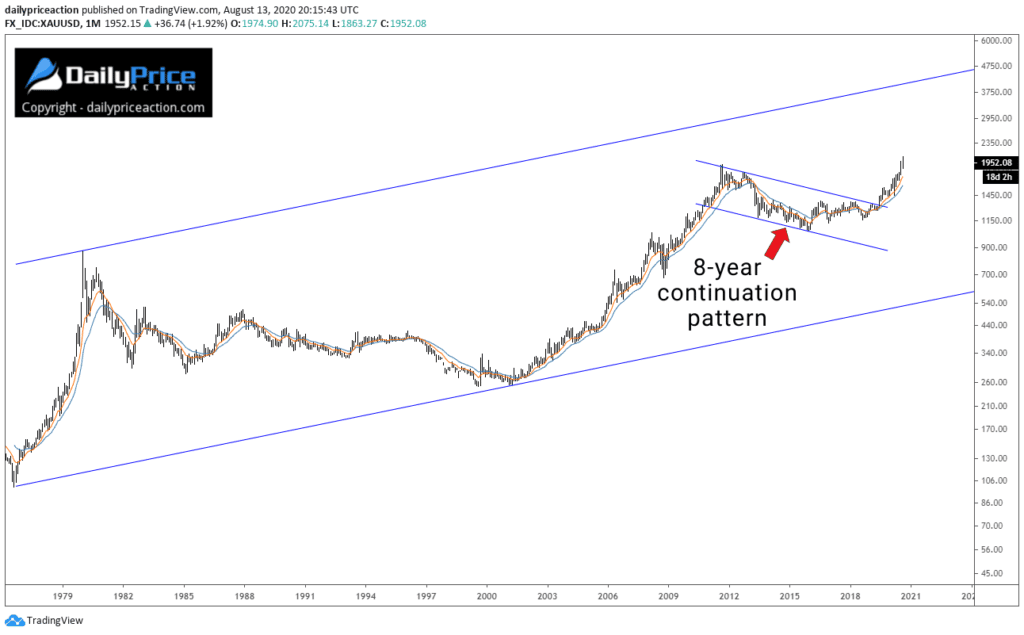

The 45-year chart of gold above says it all.

The consolidation between 2011 and 2019 formed a continuation pattern within a broader bull market for gold.

But every bull market has pullbacks.

And the more aggressive the uptrend is, the more unnerving the pullbacks are likely to be.

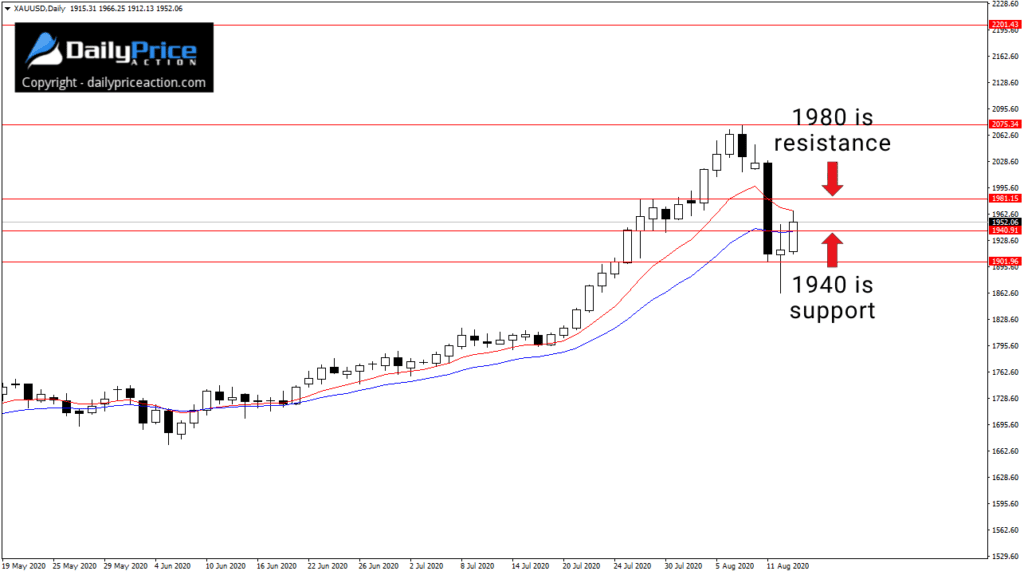

Look no further than the August 11th candle.

Countertrend moves like that are a necessary evil to shake out any “weak hands” and reset the momentum.

I’m not saying that the pullback is over, but I am still long gold via the junior miners that I bought in April.

I told DPA members about it, and those companies are still up well over 100% even after Tuesday’s pullback.

One reason I chose to invest in gold strength rather than trade is that I didn’t have to worry about volatility over the next few years.

So far, I’m glad I took that route.

As for the short-term, keep an eye on how 1940 holds as support going forward.

If XAUUSD closes above that area today, we could see gold push back toward 1980 by the end of the week.

However, 2075 is going to be the big level on everyone’s mind now.

As long as gold is below that level on a daily closing basis, expect this consolidation to continue.