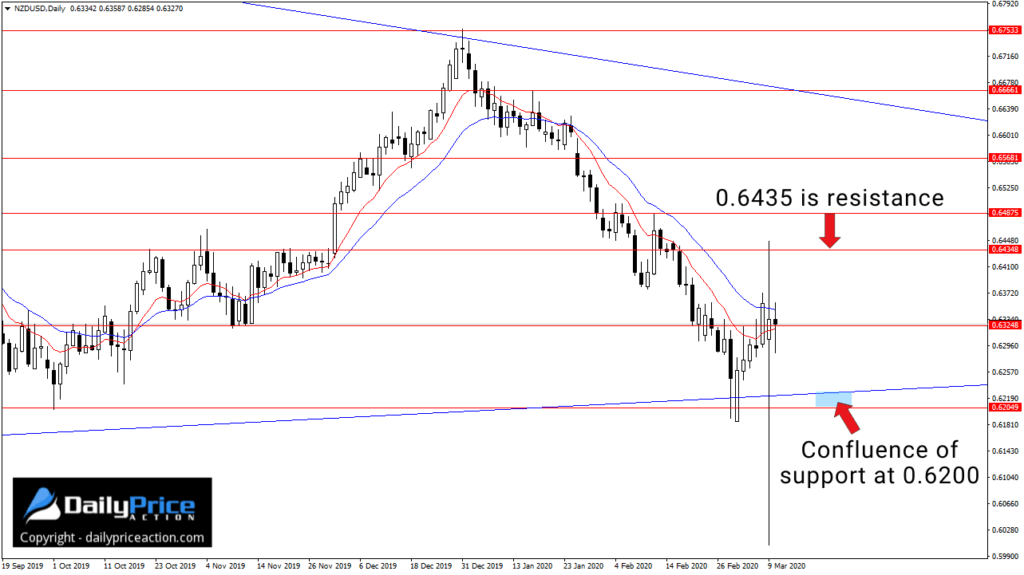

On Saturday, I discussed a possible bullish scenario for the NZDUSD.

The confluence of support at 0.6200, coupled with last week’s bullish candle, hinted at a turn higher.

However, before the week could get underway, the NZDUSD suffered a flash crash.

The pair lost more than 300 pips in less than 30 minutes.

We saw a similar move from the AUDUSD.

So, does Monday’s selloff negate what I said in Saturday’s forecast video?

Not necessarily.

In most cases, flash crashes like the one we saw here are temporary.

It is true that the selloff took out last week’s bullish engulfing candle, but what’s important now is how NZDUSD reacts to key levels.

If you watched Saturday’s video, you know that 0.6325 was the key support level that needs to hold on a daily closing basis.

Following an impressive bounce back on Monday, the NZDUSD came close to taking out that level.

Notice Monday’s 0.6333 close, though.

That close was eight pips above our 0.6325 support level, which means it’s technically still intact.

Furthermore, the NZDUSD is still well above that confluence of support at 0.6200.

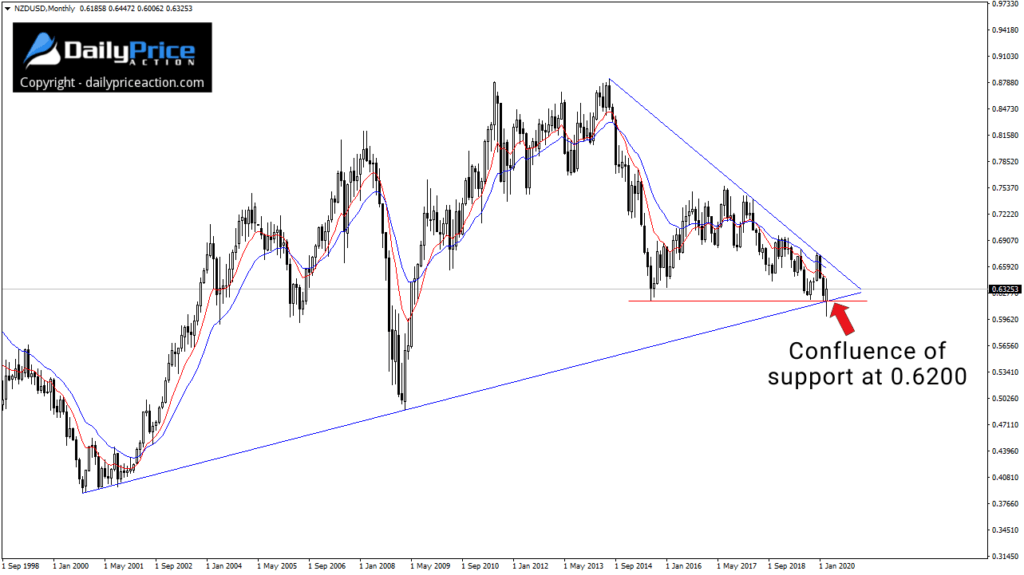

Here’s a view of the monthly time frame to show why 0.6200 is so critical for the New Zealand dollar:

I have to respect the potential for a move higher while NZDUSD is above trend line support from the 2000 lows.

Of course, that does not mean a move higher will occur.

If NZDUSD buyers do get behind the pair this week, it’s going to take a daily close above 0.6435 and 0.6490 to extend the rally.

We saw how significant that 0.6435 resistance level was on Monday.

Alternatively, a daily and weekly close below that 0.6200 area would signal continued weakness.

Until the market regains momentum one way or the other, though, the NZDUSD will be a challenging pair to trade.

That said, the multi-year terminal pattern above is one worth keeping an eye on, in my opinion.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the NZDUSD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in March!

[/thrive_custom_box]