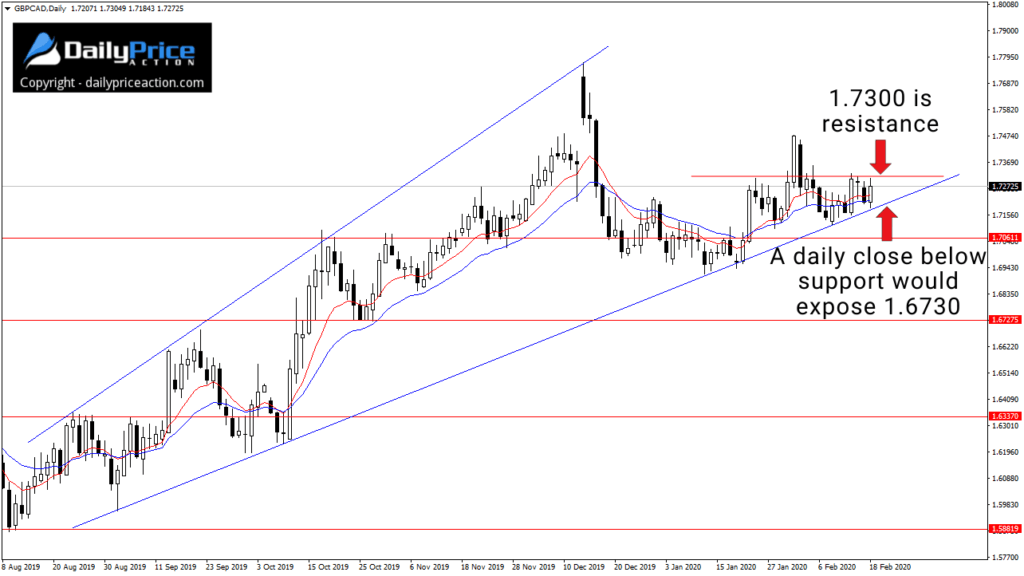

The GBPCAD continues to hover above key support.

It’s the same level I discussed on February 7th and again on Sunday.

A rising broadening wedge like the one below hints at exhaustion from buyers.

The concept is similar to a rising (narrowing) wedge, only this one isn’t a terminal pattern.

However, as I mentioned on February 7th, GBPCAD bears need to secure a daily close below wedge support near 1.7200 first.

Without that close, there is no short trade here.

The GBPCAD uptrend is also very much intact as long as the pair is trading above that 1.7200 region.

If you saw my recent posts on GBPCAD, you may be wondering why I’m writing about the pair again today.

After all, not much has changed.

It’s no secret that I’ve favored the Canadian dollar against some of the majors recently.

First was the EURCAD short idea I wrote about on February 6th.

I mentioned my EURCAD short position just below 1.4600 in the February 6th members-only video.

That trade netted 3.9R despite my early exit.

I also wrote about NZDCAD on Monday.

The pair hasn’t confirmed the break below 0.8500 yet, but NZDCAD is trading below that level as I type today’s post.

As you can tell, the Canadian dollar has held up well against the majors.

That isn’t surprising given that the Canadian dollar index is coming off the bottom of an eight-month channel.

Whether that will continue is unknown.

What I do know is that GBPCAD has a ton of potential, but a close below 1.7200 support is needed to open up lower levels, including 1.6730.

[thrive_custom_box title=”” style=”dark” type=”color” color=”#fef5c4″ border=”fadf98″]

Want to watch the GBPCAD video I just released in the member’s area?

Get a Lifetime Membership Today and receive exclusive member-only content including one to two new videos every day. Save 40% in February!

[/thrive_custom_box]